ZenGo, a mobile app to manage your cryptocurrencies, has raised a $20 million Series A funding round led by Insight Partners. ZenGo is a non-custodial wallet, which means that the company doesn’t manage your crypto assets for you — you remain in control.

Other investors include Distributed Global and Austin Rief Ventures. Existing investors Benson Oak, Samsung Next, Elron, Collider Ventures, FJ Labs and others also participated in today’s funding round.

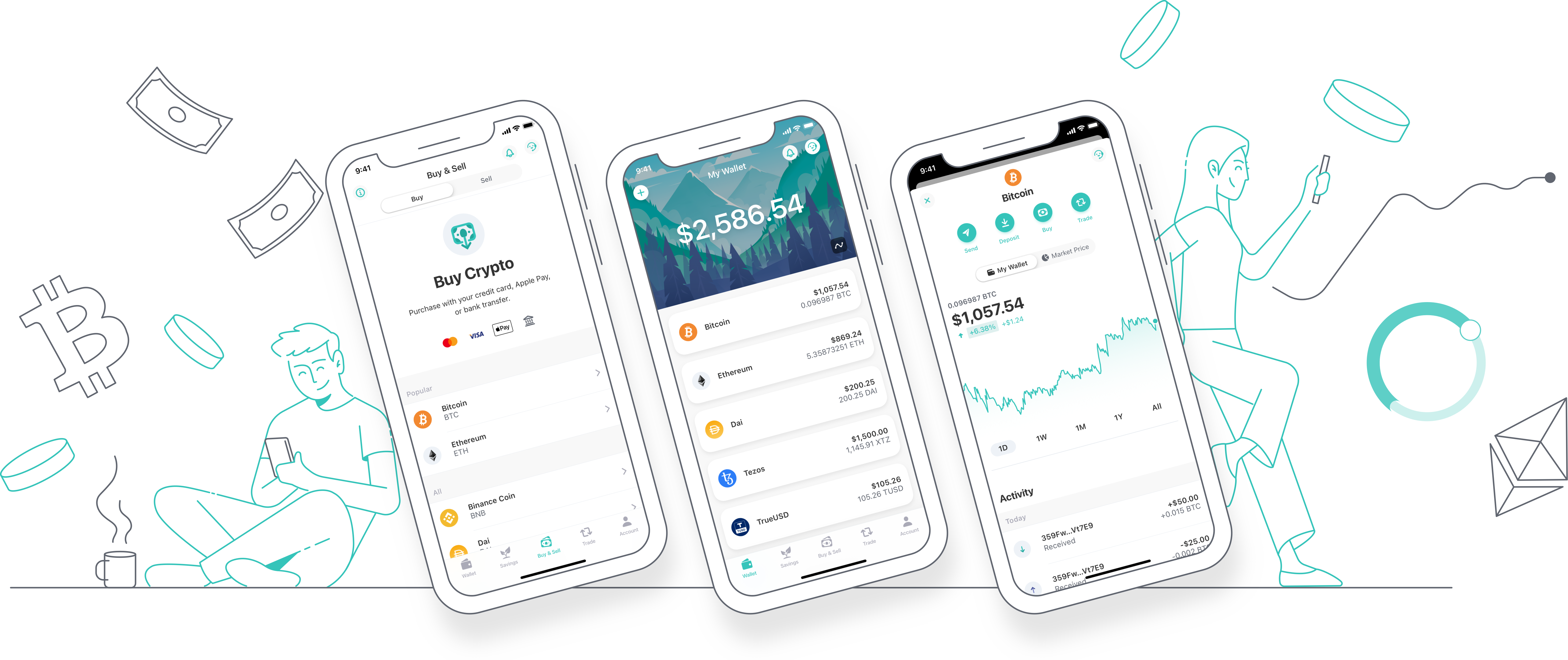

What makes ZenGo different from other wallet apps is that the company is trying to build something that is more secure than your average crypto wallet while remaining simple to use and understand. It competes with other non-custodial wallets, such as Coinbase Wallet (not Coinbase.com), Argent, etc.

In particular, ZenGo is based on multiparty computation (MPC). When you first create your wallet, ZenGo generates multiple secrets that are stored and encrypted in different ways. It means that the company can’t access your tokens directly and you can recover your wallet if you lose your phone.

Other crypto companies focused on infrastructure and enterprise clients have also opted for MPC as their security model. Fireblocks, a company that has recently raised $133 million, is one example.

But ZenGo is building a consumer app. In 2020, the company has processed over $100 million in crypto transactions from 100,000 users. ZenGo has reached the same milestone in the first three months of 2021 and added another 100,000 users.

You can browse DeFi projects through ZenGo and access savings pools. The startup takes a cut on these investments.

With today’s funding round, ZenGo plans to expand with the same philosophy in mind. You can expect support for more chains and assets, more partnerships and options to buy cryptocurrencies and convert them to fiat money, etc.

The company recently announced plans to launch a debit card. This way, users will be able to convert their crypto assets and then spend them wherever Visa cards are accepted. In other words, ZenGo is building a crypto super app with a focus on security.

Image Credits: ZenGo

from Startups – TechCrunch https://ift.tt/3eErPKN

Comments

Post a Comment