Blockchain developer platform Alchemy announced today it has raised $80 million in a Series B round of funding led by Coatue and Addition, Lee Fixel’s new fund. The company previously raised a total of $15.5 million, so the latest financing brings its total raised to $95.5 million since it launched in 2017.

The latest round caught our attention for a few reasons.

First, the company, which describes itself as the backend technology behind the blockchain industry, went from public launch to a $505 million valuation in a matter of just eight months. During that time, Alchemy says it powered over $30 billion in transactions for tens of millions of users all over the world. Second, the startup says it also already powering the majority of the NFT industry.

And finally, its investors in the round include a high-profile mix of institutions and individuals such as DFJ Growth, K5 Global, the Chainsmokers, actor Jared Leto and the Glazer family (owners of the Tampa Bay Buccaneers and Manchester United). They joined existing backers including Yahoo co-founder and former CEO Jerry Yang, Pantera Capital, Coinbase, SignalFire, Samsung, Stanford University, Google chairman and Stanford University President John L. Hennessy, Charles Schwab, LinkedIn co-founder Reid Hoffman and others.

Sources with inside knowledge of Alchemy’s operations tell TechCrunch that the company has already grown its business more than eightfold since it signed the Series B term sheet. They also said Alchemy had over $300 million of investor demand wanting to enter the round and is being inbounded to do another financing at “many times” the current valuation.

TechCrunch talked with Alchemy co-founders Nikil Viswanathan (CEO) and Joe Lau (CTO) about the raise and their passion for the startup’s mission was clear. As is its explosive growth.

“We realized that in order for space to thrive and build to its full potential, we needed to build a developer platform layer for blockchain,” Viswanathan told TechCrunch.

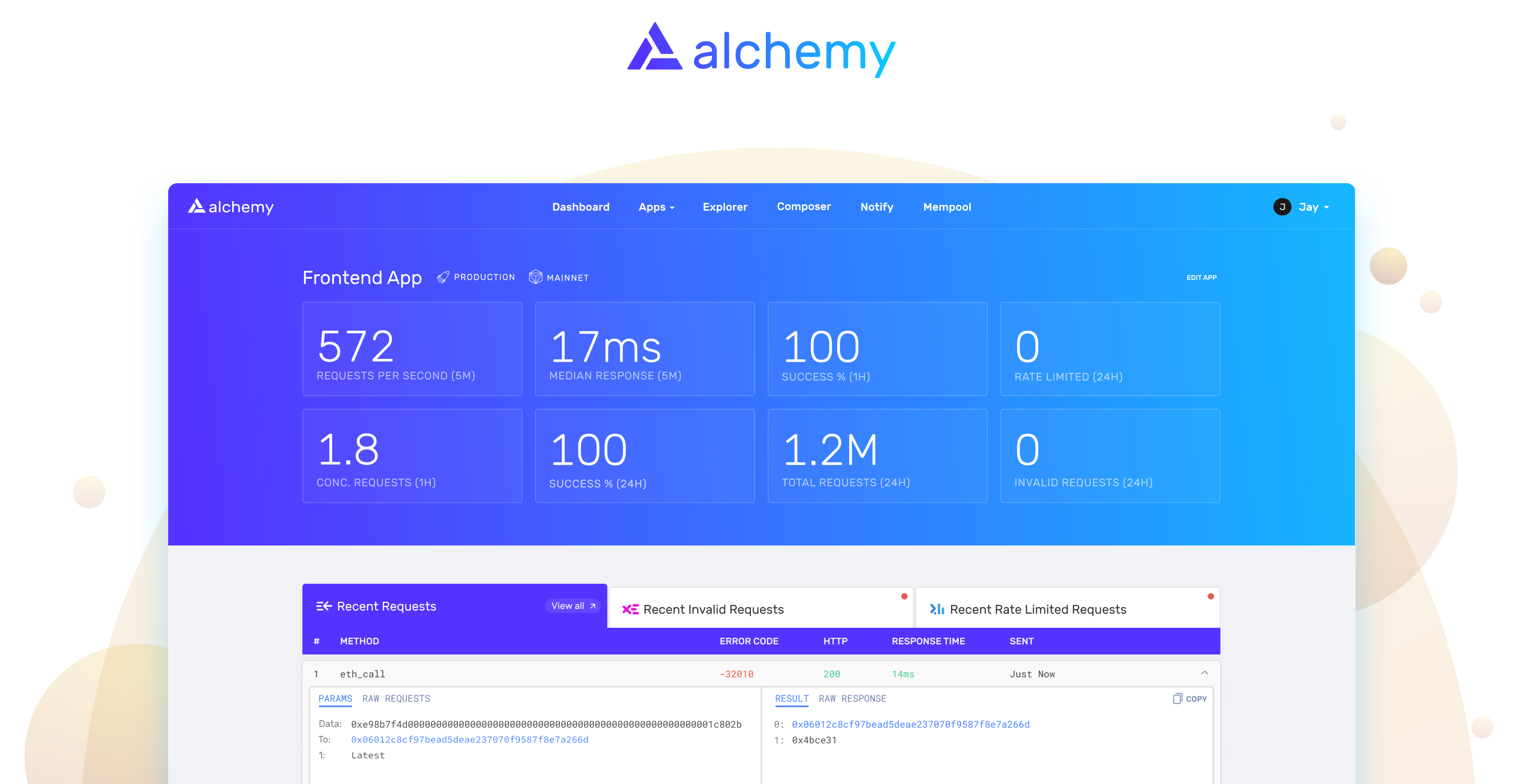

Alchemy’s goal is to be the starting place for developers considering to build a product on top of a blockchain or mainstream blockchain applications. Its developer platform aims to remove the complexity and costs of building infrastructure while improving applications through “necessary” developer tools.

The startup powers a range of transactions across nearly every blockchain vertical, including financial institutions, exchanges, billion-dollar decentralized finance projects and multinational organizations such as UNICEF. It has also quickly become the technology behind every major NFT platform, including Makersplace, OpenSea, Nifty Gateway, SuperRare and CryptoPunks.

“Every time you open DoorDash, you’re using Amazon’s infrastructure,” Lau said. “Every time you interact with an NFT, you’re using Alchemy. It’s being powered by Alchemy underneath the hood.”

While the pair would not provide hard revenue figures, the company – which operates as a SaaS business – says it increased its revenue by 600% in 2020.

For inside players, Alchemy’s efforts are paving the way for the whole industry.

“The cryptoeconomy is innovating faster than any technological movement that came before it, and Alchemy has been a key driver of that,” said Coinbase President and COO Emilie Choi. “Alchemy enables developers to build the rich ecosystem of applications necessary for mainstream blockchain adoption.”

Pantera Capital’s Paul Veradittakit describes Alchemy as “the Amazon Web Services (AWS) of the blockchain industry” that is “enabling the vision of a decentralized web.”

“While in Web 2.0, Microsoft, Apple and AWS are three of the most valuable companies in the world because they are the developer platform powering the computer and internet industries, Alchemy is primed to do the same for the blockchain,” he said.

The company believes the comparison to AWS is fair, noting that: “Just as AWS provides the platform that powers Uber, Netflix and much of the technology industry, Alchemy powers infrastructure for many large players in the blockchain industry.”

Alchemy plans to use its new capital to expand its developer platform to new blockchains, fuel global expansion and to open new offices in the U.S. and globally. The startup is based in San Francisco and is planning to open an office in New York.

“We are going to use the funds to support new chains with our developer platform,” Viswanathan said. “We also expect to 5x the team this year.”

But to be clear, Alchemy prides itself on being lean and mean.

“We just went from 14 to 22 employees,” Lau said. “We have intentionally wanted to keep the team as small as possible.”

The blockchain space has been the subject of increased investor interest as of late.

In March, BlockFi, which describes itself a financial services company for crypto market investors, announced it had closed on a massive $350 million Series D funding that valued it at $3 billion. Also last month, Chainalysis, a blockchain analysis company, revealed the close of $100 million in Series D financing, which doubled its valuation to over $2 billion.

from Startups – TechCrunch https://ift.tt/2SaL6vH

Comments

Post a Comment