Indian food delivery startup Zomato on Wednesday filed for an initial public offering, ushering a new era for tech unicorn startups in the world’s second-largest internet market after years of promising growth.

The 12-year-old Gurgaon-headquartered Indian startup, which counts Info Edge and Ant Group among its largest investors, plans to raise $1.1 billion from the IPO (about $1 billion from issuing new shares), it said in the filing to the local market regulator. The startup, which has businesses in 24 markets, intends to list on Indian stock exchanges NSE and BSE.

Zomato, which has raised more than $2.2 billion (according to research firm Tracxn), and was valued at $5.4 billion in its most recent fundraise round, said it may consider raising an additional $200 million ahead of public listing.

A lot is riding on Zomato’s eventual listing on Indian stock exchanges. A successful listing is poised to encourage nearly a dozen other unicorn Indian startups to accelerate their efforts to tap the public markets.

Indian startups have raised tens of billions of dollars in the past decade, but have so far been largely reluctant to tap the public markets. In recent years, successful listing by a handful of firms, including IndiaMart and mobile gaming firm Nazara, has shown that investors in India do have strong appetite for tech stocks.

Some key insights shared by Zomato in the filing today:

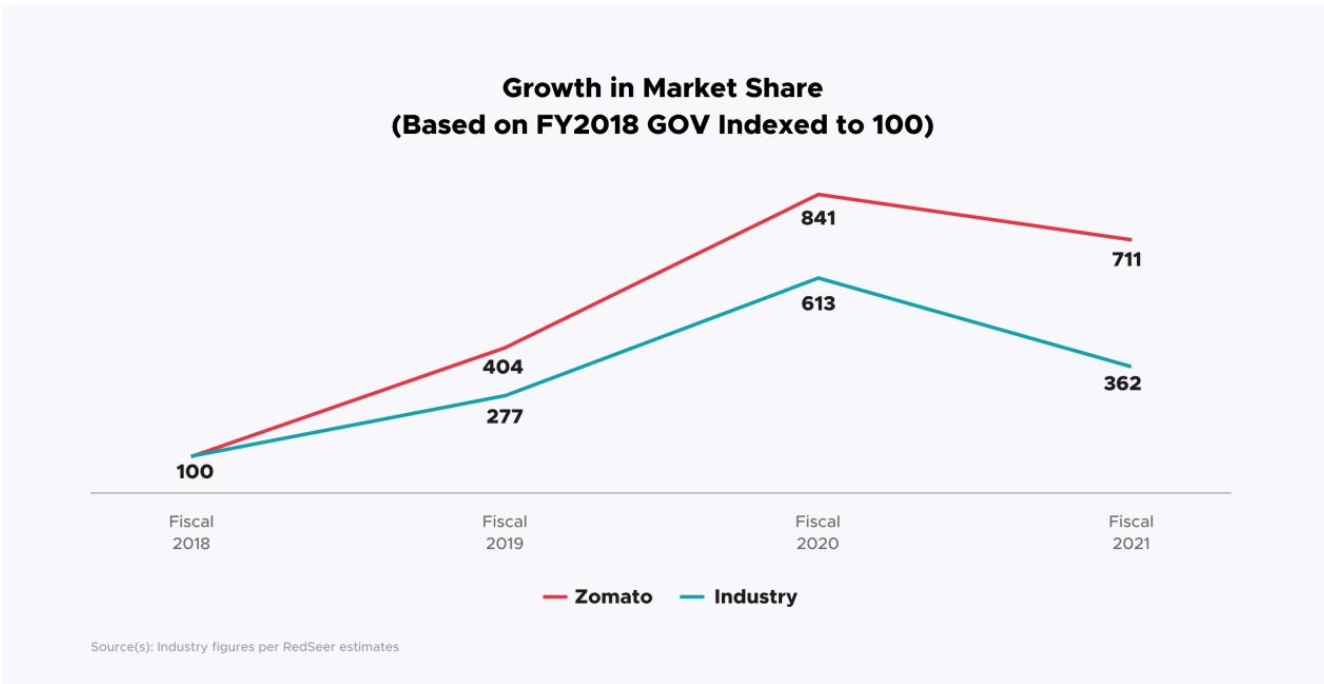

- Zomato has claimed a market-leading position in the Indian food delivery market.

- The startup identified Prosus Ventures-backed Swiggy (which is also in talks to raise capital from SoftBank Vision Fund 2, as well as restaurants such as Domino’s, McDonald’s and Pizza Hut and cloud kitchen operators such as Rebel Foods, as its competitor. (But not Amazon, which entered the Indian food delivery market last year.)

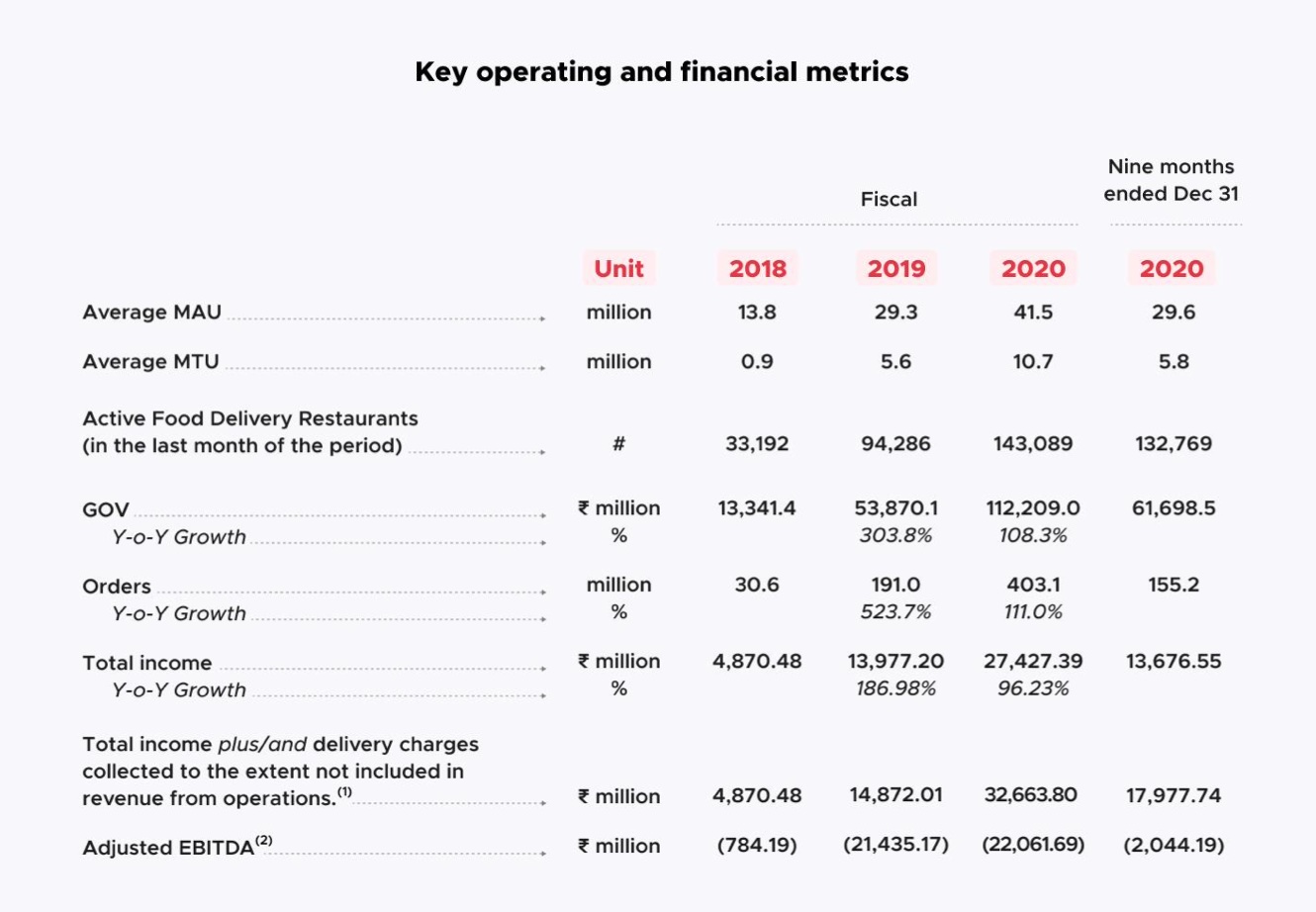

- The startup clocked $183.6 million in revenue between April 1 and December 31, 2020. Its losses during this period were $91.8 million.

- The startup said it has a history of net losses, and it anticipates increased expenses in the future.

- Info Edge plans to sell stake worth $100 million, the investment firm said in a stock exchange filing.

- Zomato has identified “changing regulation in India,” ability to raise foreign capital and “political changes” among over dozens of risk factors that could potentially affect its business in the future.

- The startup, which employs 3,469 people across the globe as of December 31, plans to invest 75% of the IPO proceedings to grow its Zomato Pro membership offering, which allows customers to avail additional benefits, and Hyperpure, its B2B supplies business, and also deepen its relationship with restaurant partners.

- Zomato says by the third quarter of last year, going by the metric GOV (gross order value), it had recovered from the COVID crisis. But some of its business lines, including the dining-out business, is “still recovering as customers continue to be reluctant to dine-out as a precautionary measure.”

- As of December 2020, the startup had 161,637 active delivery partners, 350,174 active restaurant listings on the platform, of which 132,769 restaurants were also those who actively delivered to customers.

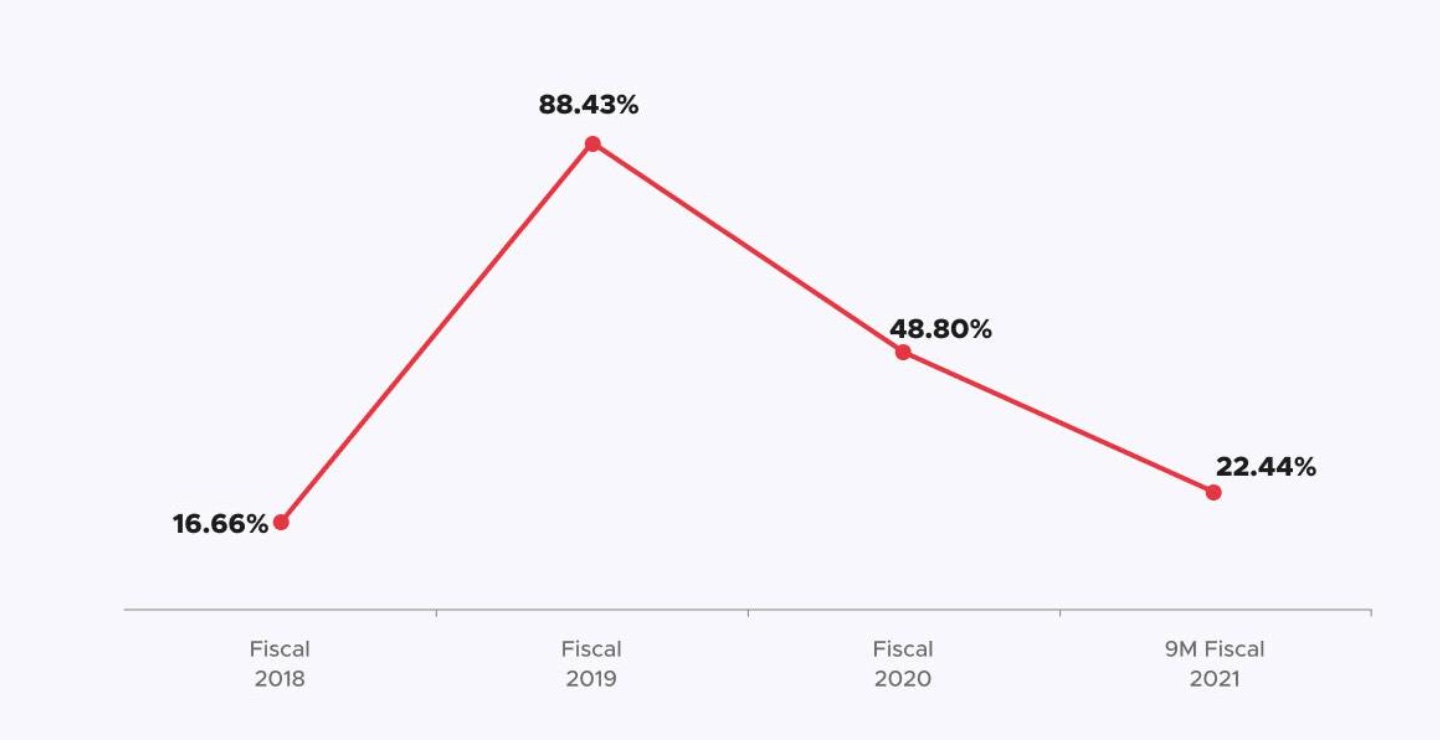

- Zomato’s advertising and sales promotion expenses as percent of its total income, over the years.

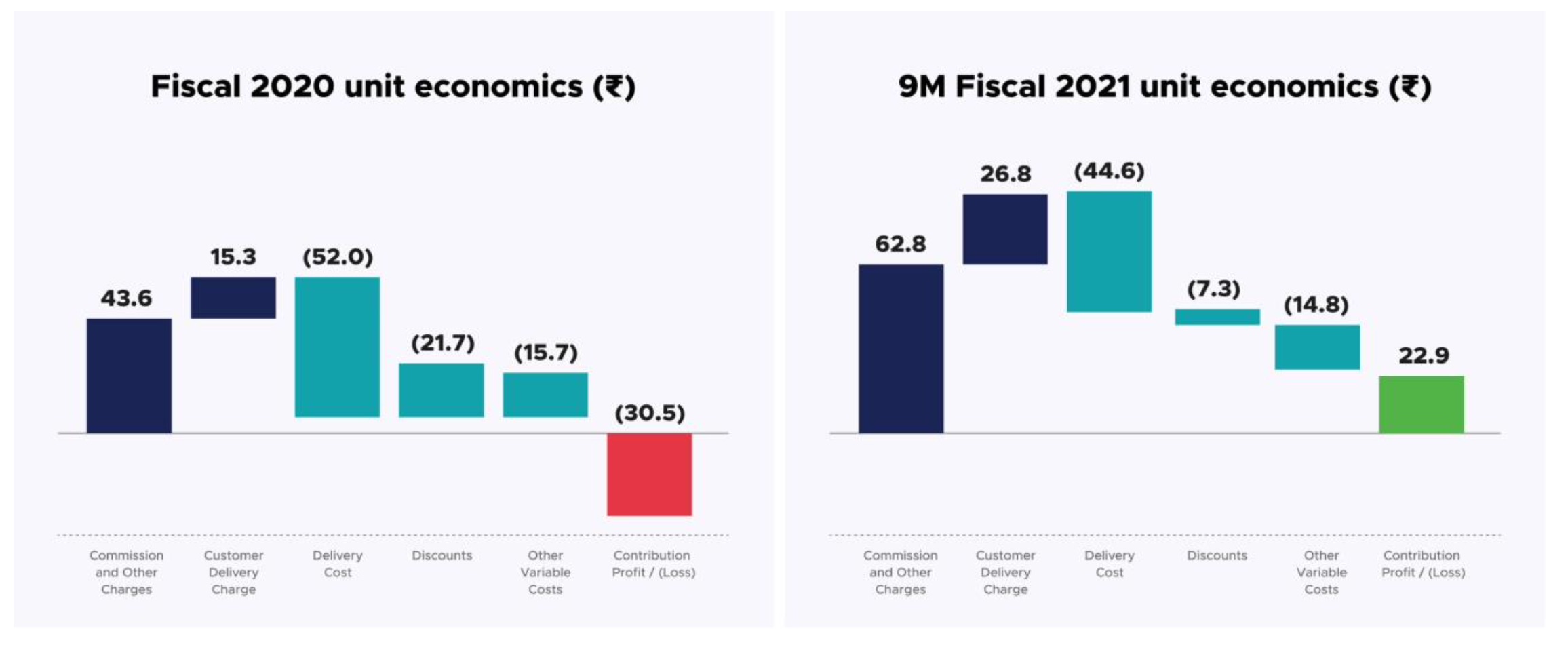

- Zomato says it has improved the unit economics of food delivery business in recent years.

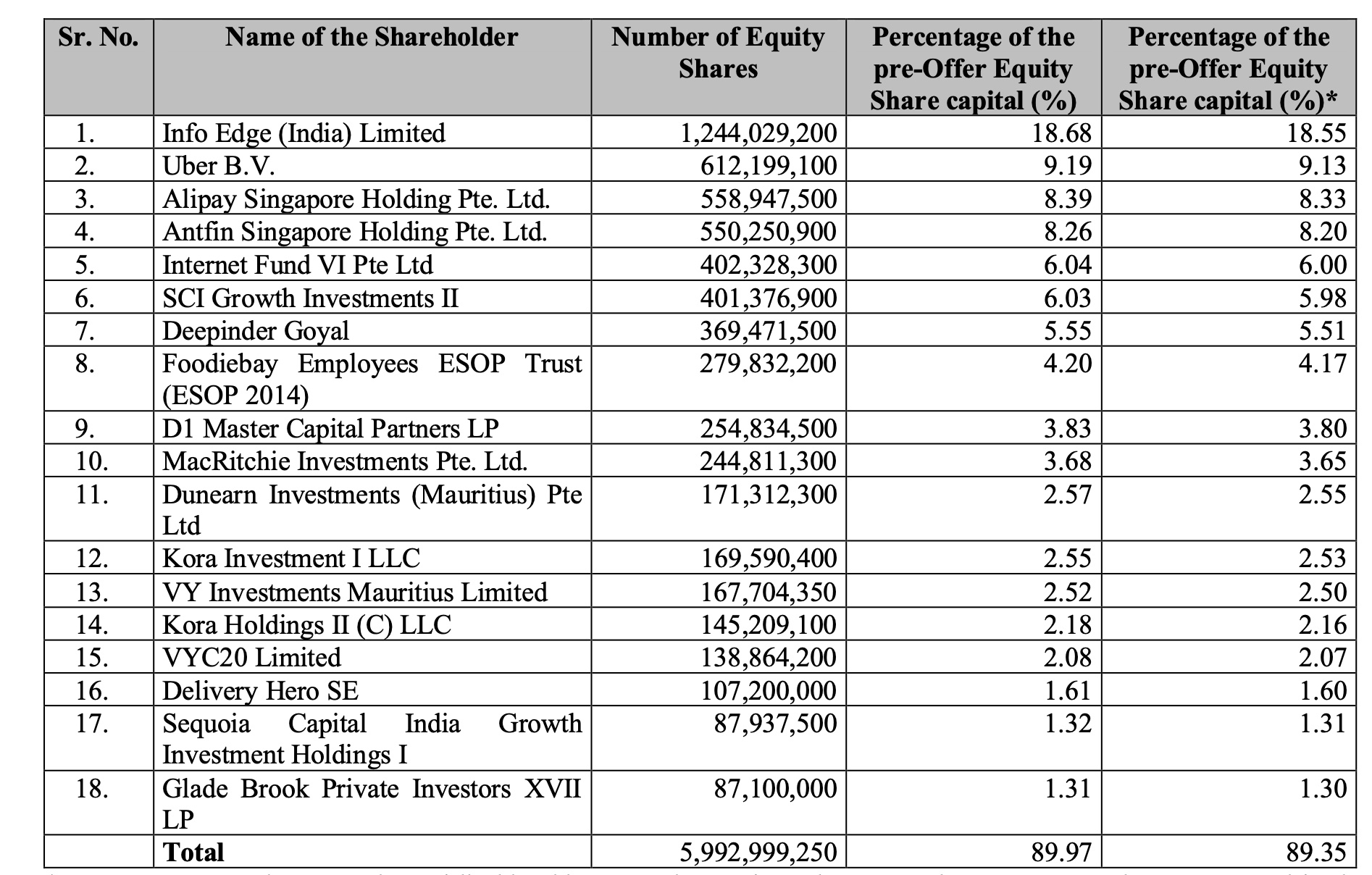

- Zomato last year acquired Uber Eats’ India business, and as part of the deal gave the American ride-hailing firm 9.9% stake in Zomato. (On a side note, it appears the only time Uber has ever turned a profit is when it has sold its businesses in some markets to local rivals.) Its current list of shareholders, which assume at least 1% of the business, stands as follows:

from Startups – TechCrunch https://ift.tt/2QBpjNf

Comments

Post a Comment