Bandit ML aims to optimize and automate the process of presenting the right offer to the right customer.

The startup was part of the summer 2020 class at accelerator Y Combinator. It also raised a $1.32 million seed round in September from YC, Haystack Fund, Webb Investment Network, Liquid 2 Ventures, Jigsaw Ventures, Basecamp Fund, Pathbreaker Ventures and various angels — including what CEO Edoardo Conti said are 10 current and former Uber employees.

Conti (who founded the company with Lionel Vital and Joseph Gilley) is a former Uber software engineer and researcher himself.

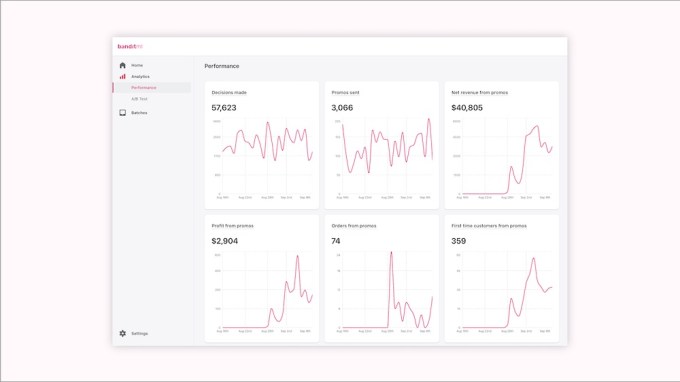

The idea, as he explained via email, is that one customer might be more excited about a $5 discount, while another might be more effectively enticed by free shipping, and a third might be completely uninterested because they just made a large purchase. Using a merchant’s order history and website activity data, Bandit ML is supposed to help them with determine which offer will be most effective with which shopper.

Image Credits: Bandit ML

Conti acknowledged that there’s other discount-optimizing software out there, but he suggested none of them offers what Bandit ML does: “off the shelf tools that use machine learning the way giants like Uber, Amazon and Walmart do.”

He added that Bandit ML’s technology is unique in its support for full automation (“some stores sent their first batch of offers within 10 minutes of signing up”) and its ability to optimize for longer-term metrics, like purchases over a 120-day period, rather than focusing on one-off redemptions. In fact, Conti said the technology the startup uses to make these decisions is similar to the ReAgent project that he worked on at Facebook.

Bandit ML is currently focused on merchants with Shopify stores, though it also supports other stores not on Shopify, like Calii. Conti said the platform has been used to send millions of dollars’ worth of promotions since July, with one clothing company seeing a 20% increase in net revenue.

“Starting with an always-on incentive engine for every online business, we aim to build functioning out-of-the-box machine learning tools that a small online business needs to compete with the Walmarts and Amazons of the world,” he said.

from Startups – TechCrunch https://ift.tt/3rgct4B

Comments

Post a Comment