Meet Multis, a French startup that is building business bank accounts, except that it lets you store, send and receive cryptocurrencies. The startup just raised a $2.2 million seed round.

Investors in today’s funding round include White Star Capital, Y Combinator, Coinbase Ventures, eFounders, Greenfield One and Digital Currency Group.

“It’s very complicated to manage crypto as a company. As soon as you want to hold crypto or start paying employees and contractors, it’s a giant mess,” co-founder and CEO Thibaut Sahaghian told me.

If you’re familiar with startups working on business banking, such as Qonto, you already know what to expect from Multis. It’s a software-as-a-servie product designed for teams.

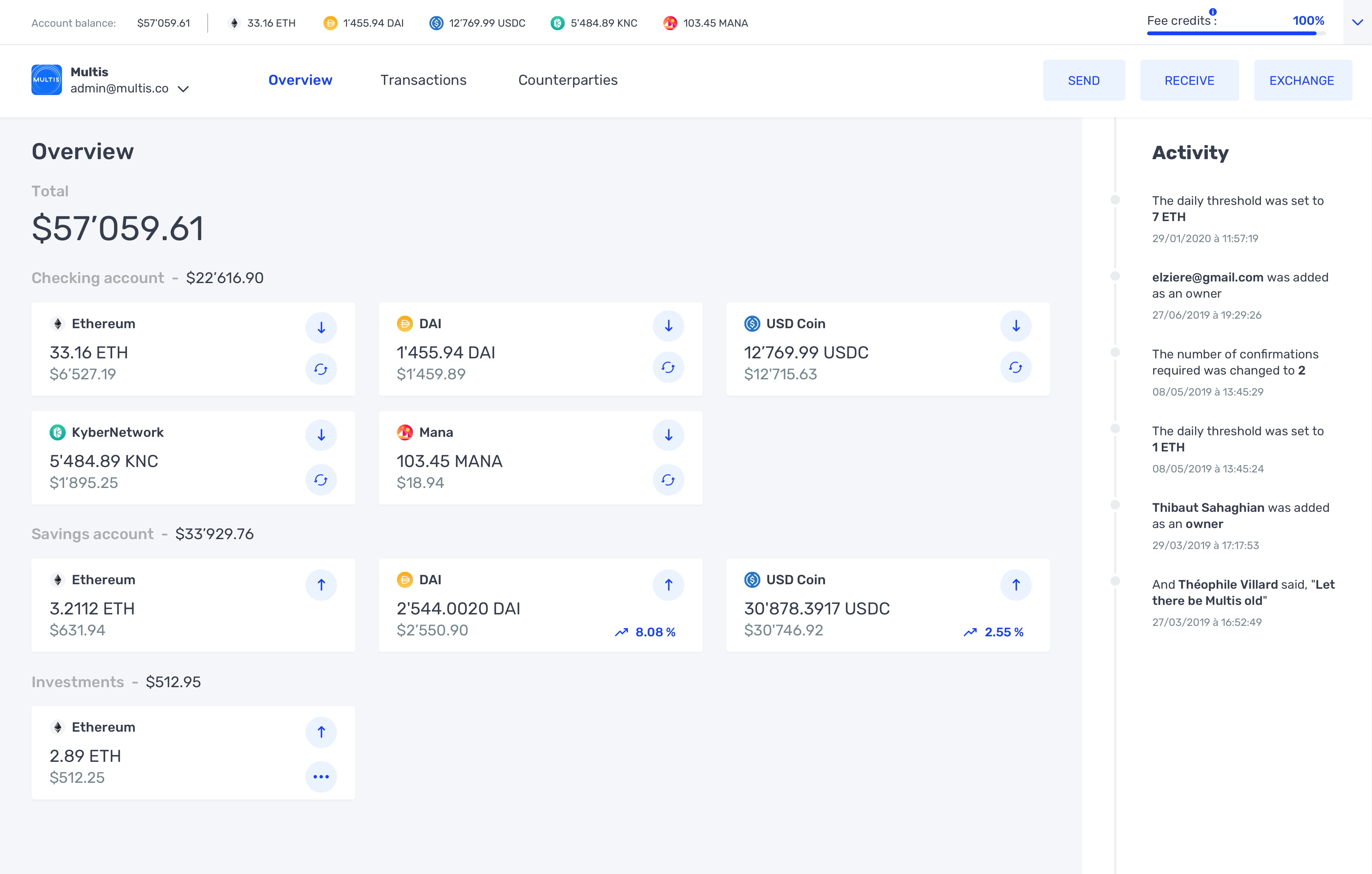

Image Credits: Multis

After creating a Multis account, you can add other team members and set permissions and limits. Behind the scene, Multis is a multisignature Ethereum wallet. The company doesn’t control the keys, which means Multis can’t access your funds.

“From a regulatory point of view, it’s been very useful because we don’t hold assets and we can’t review and block transactions,” Sahaghian said.

Thanks to the multisignature design, you can create an approval workflow so that each transaction needs to be approved by a certain number of people on the team.

Multis supports Ethereum-based ERC20 tokens, which means you can also use stablecoins, such as USDC and DAI. This way, you’re not exposed to cryptocurrency volatility when you choose to keep all your assets in USDC for instance. You can swap tokens from Multis directly.

Once you have assets in your Multis account, you can issue payments to employees, contractors, partners, suppliers, etc. You can save addresses and other relevant information to streamline payments in the future.

Centralizing all your crypto transactions on Multi can be useful when you need to file your taxes. You can export all your transactions and hand them over to your accountant.

And if you have too many assets on your hands, you can invest some assets and earn interests thanks to DeFi products. The company uses Compound for that feature.

Right now, Multis clients are mostly companies working on blockchain products, generating revenue in cryptocurrencies or paying people using stablecoins. But the company wants to simplify its product by adding EUR and USD accounts with cards and IBANs.

Multis could act as a bridge between fiat currencies and cryptocurrencies. Companies with offices in multiple countries could use it to save money on intercompany fees. The startup is still working on those new features, but it could lead to some interesting use cases.

from Startups – TechCrunch https://ift.tt/33cHCM5

Comments

Post a Comment