Stripe and Shopify have transformed the face of commerce for small business users, yet when it comes to putting that cash somewhere, SMBs have found that the banking options aren’t quite as transformative.

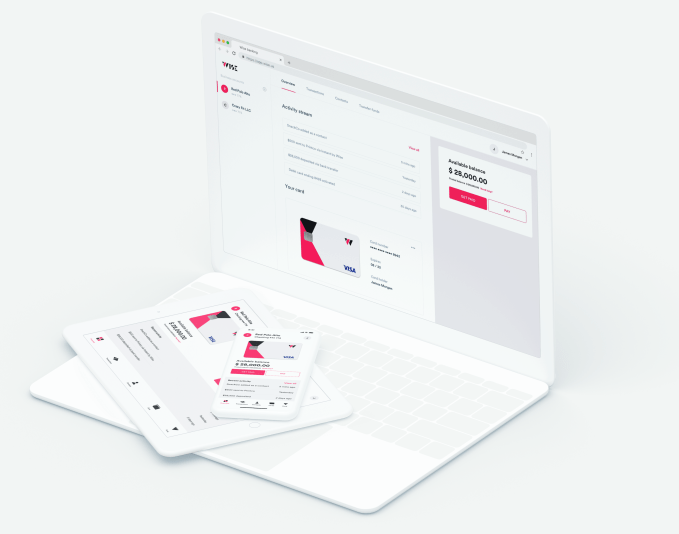

Wise is a new challenger bank built specifically for small businesses. The startup is aiming to insert itself as an essential service in the small business repertoire by bundling banking with payment services powered by Stripe. Customers can receive payments, manage their cash and pay employees all via Wise’s app.

CEO Arjun Thyagarajan tells TechCrunch that his company has closed a $5.7 million seed round led by Base10 Partners. Abstract Ventures, Backend Capital, The Fund and Two Culture Capital also participated in the round.

While the advent of challenger banks has helped drive plenty of innovation on the consumer banking side, says Rexhi Dollaku, a principal at Base10 who led the Wise deal, “very little of that innovation has happened in the business banking context.”

Thyagarajan and his investors hope that the startup can keep churn low by embedding a wider scope of financial services products inside its core product, expanding beyond the traditional scope of banking features by offering functionality to power things like payroll and accounting.

Rather than plunging into direct customer sales, Wise is partnering with behemoth platforms like Shopify to onboard small businesses where they already are. “If you look at other [banking] options out there, they’re going direct to the customer; what we’ve learned is that it is better to partner,” Thyagarajan says. “They’re signing up inside these ecosystems so we want to partner with these ecosystems.”

The small team has already built up a customer base of 1,000 businesses. The average Wise customer has between 2-10 employees and is pulling in somewhere between $500,000 and $5 million in ARR, the company tells us. Bank accounts on Wise’s platform are FDIC-insured up to $250,000 through the startup’s partnership with banking partner BBVA USA.

While Thyagarajan says they’ve seen online spend increasing, the COVID-19 pandemic has impacted plenty of Wise’s potential customers, and has pushed the company to stay flexible in the businesses they cater to. “I think a lot of industries are going to get accelerated and fast-forwarded,” he says. “The customers we want to cater to are rapidly modernizing.”

Alongside the funding announcement, the startup shared that Raghav Lal, a former general manager of Small Business at Visa, will be joining the startup as its president.

from Startups – TechCrunch https://ift.tt/2zKMsnP

Comments

Post a Comment