Three former Uber engineers, who helped build the company’s Michelangelo machine learning platform, left the company last year to form Tecton.ai and build an operational machine learning platform for everyone else. Today the company announced a $20 million Series A from a couple of high-profile investors.

Andreessen Horowitz and Sequoia Capital co-led the round with Martin Casado, general partner at a16z and Matt Miller, partner at Sequoia joining the company board under the terms of the agreement. Today’s investment combined with the seed they used to spend the last year building the product comes to $25 million. Not bad in today’s environment.

But when you have the pedigree of these three founders — CEO Mike Del Balso, CTO Kevin Stumpf and VP of Engineering Jeremy Hermann all helped build the Uber system — investors will spend some money, especially when you are trying to solve a difficult problem around machine learning.

The Michelangelo system was the machine learning platform at Uber that looked at things like driver safety, estimated arrival time and fraud detection, among other things. The three founders wanted to take what they had learned at Uber and put it to work for companies struggling with machine learning.

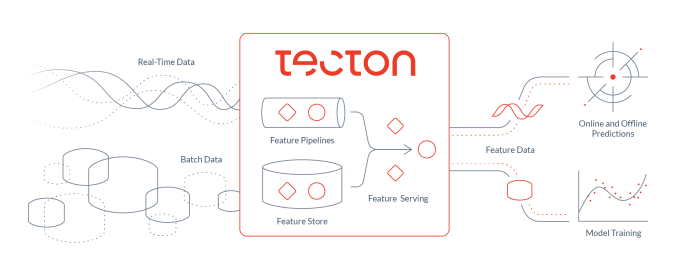

“What Tecton is really about is helping organizations make it really easy to build production-level machine learning systems, and put them in production and operate them correctly. And we focus on the data layer of machine learning,” CEO Del Balso told TechCrunch.

Image Credit: Tecton.ai

Del Balso says part of the problem, even for companies that are machine learning-savvy, is building and reusing models across different use cases. In fact, he says the vast majority of machine learning projects out there are failing, and Tecton wanted to give these companies the tools to change that.

The company has come up with a solution to make it much easier to create a model and put it to work by connecting to data sources, making it easier to reuse the data and the models across related use cases. “We’re focused on the data tasks related to machine learning, and all the data pipelines that are related to power those models,” Del Balso said.

Certainly Martin Casado from a16z sees a problem in search of a solution and he likes the background of this team and its understanding of building a system like this at scale. “After tracking a number of deep engagements with top ML teams and their interest in what Tecton was building, we invested in Tecton’s A alongside Sequoia. We strongly believe that these systems will continue to increasingly rely on data and ML models, and an entirely new tool chain is needed to aid in developing them…,” he wrote in a blog post announcing the funding.

The company currently has 17 employees and is looking to hire, particularly data scientists and machine learning engineers, with a goal of 30 employees by the end of the year.

While Del Balso is certainly cognizant of the current economic situation, he believes he can still build this company because he’s solving a problem that people genuinely are looking for help with right now around machine learning.

“From the customers we’re talking to, they need to solve these problems, and so we don’t see things slowing down,” he said.

from Startups – TechCrunch https://ift.tt/2W5u7ZX

Comments

Post a Comment