French startup Shine is adding a new option today. If you think there’s a chance that a client is not going to pay your next invoice, you can insure that invoice to avoid any bad surprise.

Shine is building a challenger bank for freelancers and small companies. It lets you send and receive money in a separate business account, pay with a MasterCard, create invoices and stay on top of administrative tasks.

It also helps you get started as the startup can fill out all administrative paperwork to register yourself as a freelancer. You also get notifications to remind you that you should pay your taxes and more. Starting accepting freelancing jobs can be confusing and Shine can help you with that.

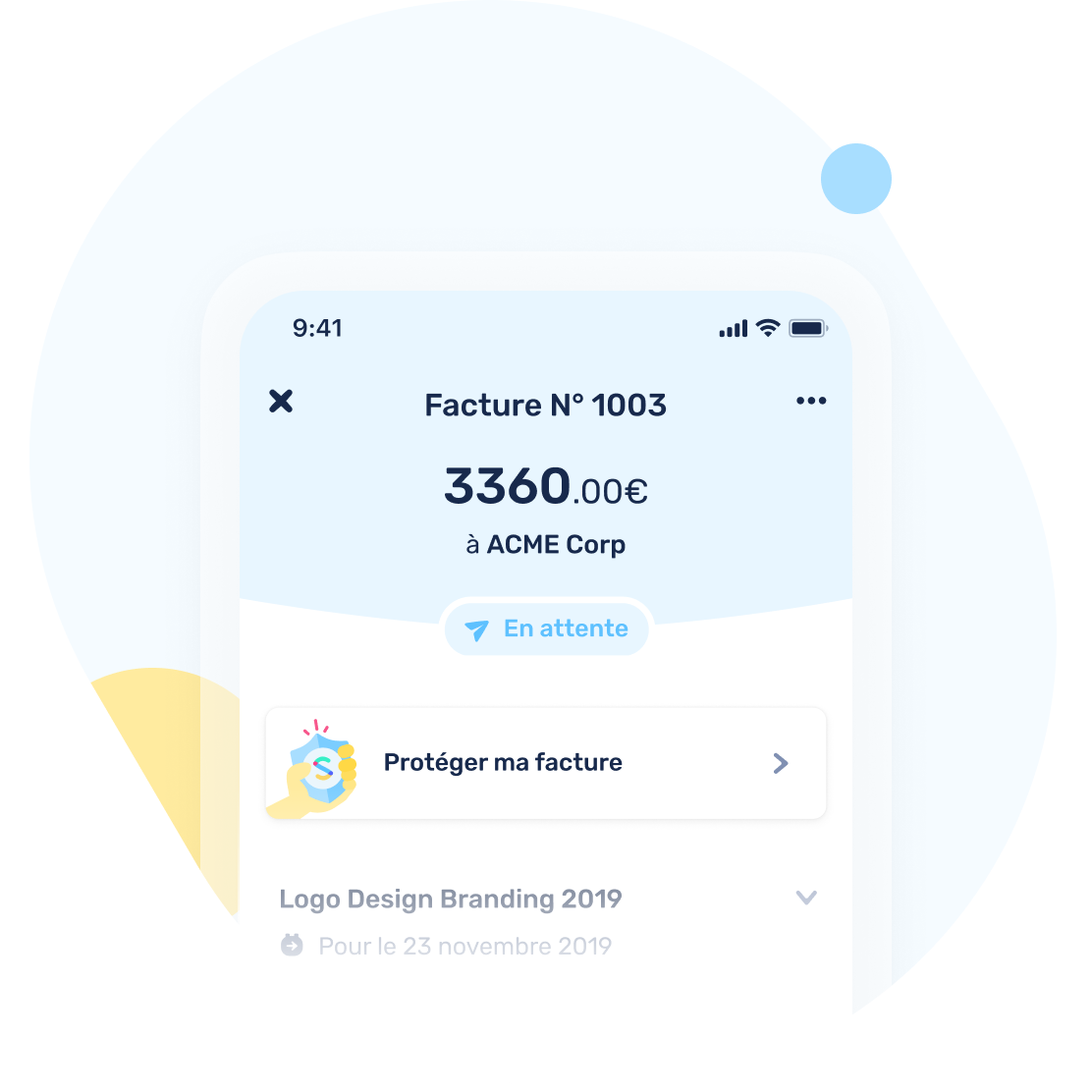

Shine has a built-in invoicing tool. It lets you add a client and generate an invoice directly in the mobile app. After that, you can send a link to your client. You get a notification when your client opens the invoice. They can download a PDF and get your bank details to pay you.

And yet, many clients often wait until the last minute to pay an invoice. It can be a month or two after finishing a job, which means that they also forget about outstanding invoices.

In a few weeks, Shine users will be able to create an invoice and insure it before sending it. It costs you 2% of your total amount on your invoice. There’s no subscription fee, it’s a one-off process.

If your client hasn’t paid you after the due date, Shine will reach out to your client again to try to get the payment. If that doesn’t work, you can file a claim with the partner insurance company.

In that case, if the company is still operating, you get paid 100% of your invoice. If the company has collapsed, you get 90% back. (Of course, that’s without taking into account the 2% fees you already paid.)

from Startups – TechCrunch https://ift.tt/2y35K75

Comments

Post a Comment