Hi, I’m Ann.

I was one of the first investors in Lyft, Refinery29 and Xamarin. I’ve been on the Midas List for the past three years and was recently named on The New York Times’ list of The Top 20 Venture Capitalists. In 2008, I co-founded Floodgate, one of the first seed-stage VC funds in Silicon Valley. Unlike most funds, we invest exclusively in seed, making us experts in finding product-market fit and building a minimum viable company. Seed is fundamentally different from later stages, so we’ve made it more than a specialty: It’s all we do. Each of our partners sees thousands of companies every year before electing to invest in only the top three or four.

For the past 11 years, I’ve invested at the inception phase of startups. We’ve seen startups go wildly right (Lyft, Refinery29, Twitch, Xamarin) and wildly wrong. When I reflect on the failures, the root cause inevitably stems from misconceptions around the nature of product-market fit.

True product-market fit is a minimum viable company

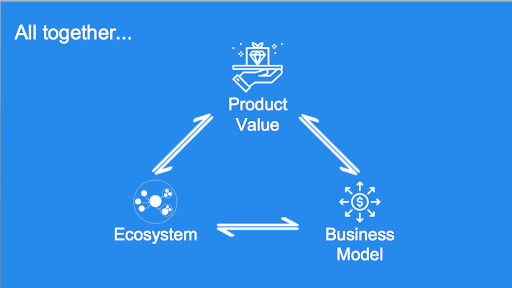

Before attempting to scale your minimum viable product, you should focus on cultivating your minimum viable company. Nail down your value proposition, find your place in the broader ecosystem and craft a business model that adds up. In other words, true product-market fit is actually the magical moment when three elements click together:

To have built a minimum viable company, these three elements must work in concert together:

- People must value your product enough to be willing to pay for it. This value also determines how you package your product to the world (freemium versus free to pay versus enterprise sales).

- Your business model and pricing must fit your ecosystem. They must also generate enough sales volume and revenue to sustain your business.

- Your product’s value must satisfy the needs of the ecosystem and the ecosystem needs to accept your product.

Many entrepreneurs conceptualize product-market fit as the point where some subset of customers love their product’s features. This conceptualization is dangerous. Many failing companies have features that customers loved. Some even have multiple beloved features! Great features constitute only one-half of one-third of the whole puzzle. To have created a minimum viable company, a company needs all three of these elements — value propositions, business model and ecosystem — working in concert.

So founders take heed…

Moving into “growth mode” while missing any of these elements is building your company on an unsound foundation.

Founders who tune out the latest tweet cycle on “the secrets to raising Series A” and focus instead on the intricacies of their own business will find that product-market fit is a predictable, achievable phenomenon. On the other hand, founders who prematurely focus on growth without knowing the basic ingredients of their minimum viable company often fuel an addictive and destructive cycle around their business’ fake growth, acquiring non-optimal users that contribute to their company’s destruction.

Read an extended version of this article on Extra Crunch.

from Startups – TechCrunch https://ift.tt/36HwTbf

Comments

Post a Comment