Hi, I’m Ann.

I was one of the first investors in Lyft, Refinery29 and Xamarin. I’ve been on the Midas List for the past three years and was recently named on The New York Times’ list of The Top 20 Venture Capitalists. In 2008, I co-founded Floodgate, one of the first seed-stage VC funds in Silicon Valley. Unlike most funds, we invest exclusively in seed, making us experts in finding product-market fit and building a minimum viable company. Seed is fundamentally different from later stages, so we’ve made it more than a specialty: It’s all we do. Each of our partners sees thousands of companies every year before electing to invest in only the top three or four.

For the past 11 years, I’ve invested at the inception phase of startups. We’ve seen startups go wildly right (Lyft, Refinery29, Twitch, Xamarin) and wildly wrong. When I reflect on the failures, the root cause inevitably stems from misconceptions around the nature of product-market fit.

The magic of product-market fit

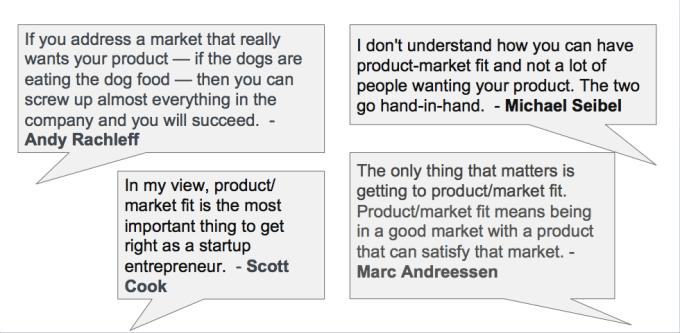

Most successful entrepreneurs and VCs agree that product-market fit is the defining quality of an early-stage startup. Getting to product-market fit allows you to succeed even if you aren’t optimized on other fronts.

Most entrepreneurs conceptualize product-market fit as the point where some subset of customers love their product’s features. At Floodgate, we forensically analyzed companies that died and concluded this conceptualization is wrong. Many failing companies had features that customers loved. Some of these companies even had multiple beloved features! We discovered that having customers love the product is merely a part of product-market fit, not the entire thing. This raises the question: What were they lacking?

from Startups – TechCrunch https://ift.tt/2u8gDmi

Comments

Post a Comment