Cequence Security, a startup that helps companies protect applications against business logic attacks, announced a $17 million Series B investment today.

The round was by led by Dell Technologies Capital with participation from Shasta Ventures, the firm that had led the company’s $8 million A round last year. Today’s investment brings the total raised to $30 million, according to the company.

What the company does, according to CEO Larry Link, is protect applications against attacks that look like they could be normal behavior, yet are actually trying to do harm to a service. Specifically, it looks for automated bot attacks on business logic such as content scraping, account takeovers, reputation bongs, shopping bots, fake account creation and denial of inventory.

The company has a three-part approach to protecting applications from these kinds of attacks. First, the discovery phase where it finds vulnerabilities are in an application. Next, it detects who is taking advantage of these openings, and finally it defends against the attack and helps turn them away.

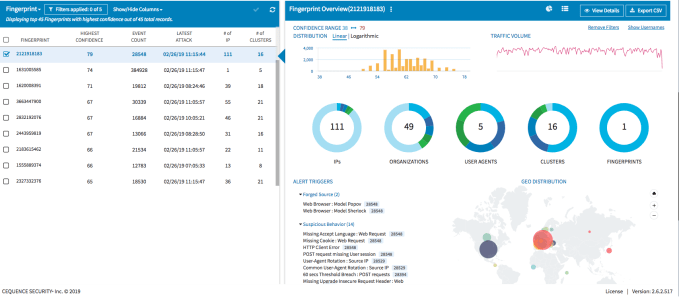

Screen: Cequence Security

Deepak Jeevankumar, who is leading the investment for Dell, sees a seasoned leader in Link, who spent 5 years running sales at Palo Alto Network, helping build the company into a powerhouse. Jeevankumer also likes the technical team, which helped build Symantec’s anti-malware platform. “It’s the perfect combination of top-notch go-to-market leadership and cyber technologists that is winning the confidence of many Fortune 100 customers in a short period of time,” he told TechCrunch.

One of the things that Jeevankumer liked about this approach was how it differed from more traditional application security strategy. “Traditional web application firewalls, DDOS products, RASP/IAST/DAST application security vendors can’t look in to these business logic level attacks as they focus on code-level issues. We are seeing enterprises moving a good part of their cyberspend in to this ‘business logic security’ category,” he said.

While it’s still early days for the company, which came out stealth in November, it is attracting large deals with an average size of $500,000, according to Link. Part of this is investment is going to go toward building its sales and marketing team to create awareness and sell directly to companies like financial services, social media, retail and gaming that could benefit from this kind of protection.

The company was founded in 2014, but spent a fair amount of time building the product before going to market for the first time last year. It currently has 34 employees working out of its Sunnyvale, California headquarters. That number is expected to increase fairly substantially with the new investment.

from Startups – TechCrunch https://ift.tt/2T1ZSEI

Comments

Post a Comment