QuotaPath, which has developed a commission-tracking solution for sales and revenue teams, has raised $21.3 million in a Series A funding round led by Insight Partners.

Existing backers ATX Ventures, Integr8d Capital, Stage 2 Capital and HubSpot Ventures also participated in the financing, which brings the startup’s total funding to $26.3 million since its 2018 inception.

The funding comes amid a year of growth for the startup, which has dual headquarters in Austin and Philadelphia. Specifically, QuotaPath has seen 600% revenue growth since January 2021. It has over 5,000 users on the platform, 40% of which are paid. Customers include Guru, Contractbook, Mailgun, Cloud Academy, SaaSOptics and OSG.

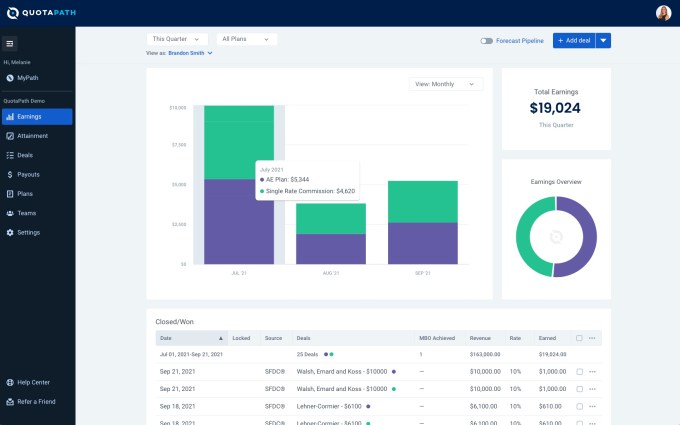

AJ Bruno, Cole Evetts and Eric Heydenberk founded QuotaPath with the mission of helping “companies build and scale high-performing, motivated growth teams.” The startup said it gives teams a way to streamline the commission process and avoid inaccurate budgets, incorrect payouts, and “unhappy sales reps due to poor sales commission planning, reporting and administration.”

Through real-time CRM integrations with Salesforce, HubSpot and Close.com, sales reps are able to glean more insight into earnings and quota attainment, the company said.

Bruno is no stranger to startups, having co-founded Austin-based PR analytics company TrendKite, which sold to rival Cision in 2019 for $225 million. It was there that Bruno ran the sales and management teams, and about “30 folks into it,” was having some issues with compensation and commission. It took a month and getting several people involved to get the situation sorted. After trying to onboard a sales and commission tool for eight months and “failing miserably,” Bruno saw an opportunity.

“The reps needed to understand what their comp plans were and they didn’t have real-time visibility into the earnings and forecasting of their compensation,” he said. So he and Evetts (who was director of revenue and sales operations at TrendKite) ultimately set about creating a workflow to solve the problem. Heydenberk joined as a technical co-founder and the company went on to raise about $5 million in pre-seed and seed funding.

“What we ultimately said was going to be our north star is that we want the sales team and the sales reps to easily understand the compensation plans, and to do that, we had to build an onboarding setup where it didn’t look like a spreadsheet that was in Excel because most sales reps don’t understand Excel,” Bruno recalled. The team then spent a year working with end users and sales reps to build the back-end infrastructure of the platform so that sales teams could “interpret what was actually happening and all the mechanisms behind it.”

Requirements were that it was fast to onboard (less than one week) and easily adjustable so that customers could make changes in real-time themselves and not have to wait on a company to make them.

“With QuotaPath, a sales team can forecast more earnings and create more goals around what they want to do,” Bruno said, “and connect those goals to the bottom line of the company.”

Image Credits: QuotaPath

The startup launched its paid platform in June 2020 and works with companies with as few as three reps to as many as a few hundred that range from SaaS to commerce shops to low-tech businesses such as wedding venues and funeral homes.

“With 10.5 million salespeople in the U.S., this is a very large market,” Bruno said. Indeed, there are a number of other startups addressing the space. Earlier this year, CaptivateIQ, which has developed a no-code platform to help companies design customized sales commission plans, announced it had raised $46 million in a Series B round led by Accel.

QuotaPath currently has 28 employees and plans to use its new capital to double its headcount by year’s end. It also plans to work on scaling partnerships and expanding product offerings to finance and HR functions.

Rachel Geller, managing director at Insight Partners, is taking a seat on the company’s board as part of the financing. She said that a priority of Insight Onsite, the firm’s ScaleUp engine, is to help its portfolio “build high-performing and scalable sales and marketing functions.”

“Our sales experts are in the trenches understanding the challenges sales teams face, and tracking sales commissions is top of mind,” she said. “Organizations need a formula-free solution to their current pain of spreadsheets and legacy solutions, and QuotaPath presents a clear alternative.”

In particular, Geller said Insight was impressed by QuotaPath’s “ease of use and fast time to deploy” compared to other solutions.

“QuotaPath customers can be up and running in days,” she said.

from Startups – TechCrunch https://ift.tt/3i5p8om

Comments

Post a Comment