Otrium has raised a $120 million round just a year after raising its $26 million Series B round. BOND and returning investor Index Ventures are leading the round. Existing investor Eight Roads Ventures is also participating.

The concept behind Otrium is quite simple. When items reach the end-of-season status, brands can list those items on Otrium and keep selling them. Otrium is currently available in Europe. Right now, many brands have their own end-of-season sales. But there are some limits to this model.

Those companies often can’t sell their entire back inventory this way. Moreover, the most luxurious fashion brands don’t necessarily want to put a cheaper price tag on their items in their own stores. That’s why a lot of clothing produced stays unsold — and by unsold, it means that those items often get destroyed.

With Otrium, brands can add another sales channel for those specific items. And selling those items online makes a ton of sense as you don’t want to manage small end-of-season inventories across multiple stores. One big online inventory is all you need.

And because some brands are reluctant about selling outdated items, Otrium tries to be as friendly as possible with fashion companies. They retain control over pricing, merchandising and visibility of their excess inventory.

The startup also recently launched advanced analytics. The idea here is that Otrium can help brands identify evergreen products that should remain available year after year.

“We believe that the fashion world will see a rebalancing in the next few years, with more sales being driven by iconic items that brands sell year after year, and will be less reliant on new seasonal launches,” co-founder and CEO Milan Daniels said in a statement.

And it would be a win-win for everyone involved. Otrium would end up selling items that remain relevant for a longer time. And fashion brands could slowly build an evergreen collection of items that would nicely complement their fast fashion collections.

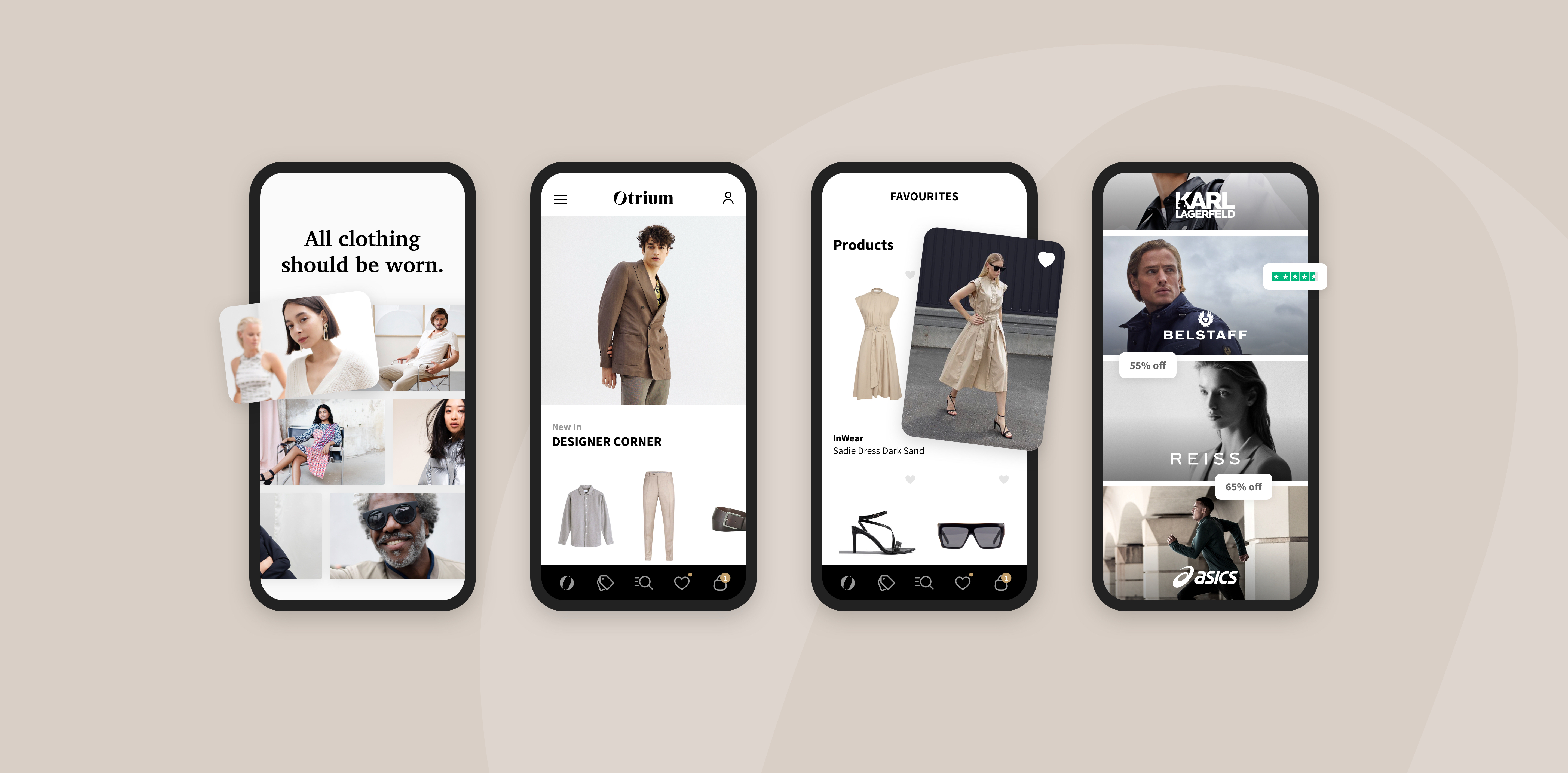

With today’s funding round, Otrium plans to expand to the U.S. The company currently works with several well-known fashion houses, such as Karl Lagerfeld, Joseph, Anine Bing, Belstaff, Reiss and ASICS.

Image Credits: Otrium

from Startups – TechCrunch https://ift.tt/3czs1uW

Comments

Post a Comment