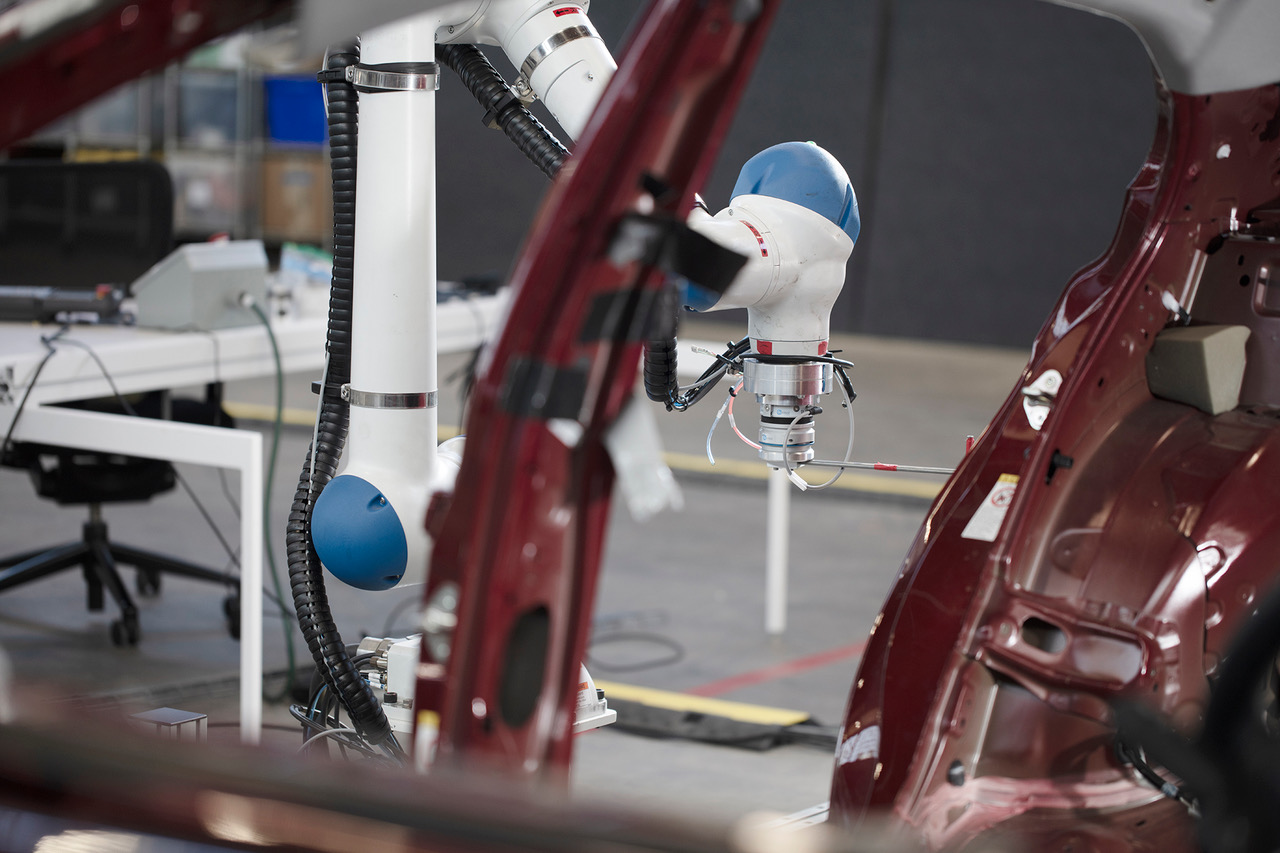

Bay Area-based AI startup Symbio today announced its “official launch.” Backed by a total of $30 million in funding, the company has struck deals with both Nissan and Toyota to implement its software in U.S.-based factories.

The company says its SymbioDCS technology is capable of dramatically increasing automation with factory robots on the assembly line.

“To the end customer, the proposition is pretty straightforward,” CEO and co-founder Max Reynolds tells TechCrunch. “We’re improving the efficiency of their automation. The high-level goal is to increase the capacity of the factory and enable them to build more product, more quickly, more flexibly. “

The company closed a $15 million Series B in December of last year. That adds to a $12 million Series A in 2018, $2.5 million seed two years prior and a $500,000 pre-seed. This latest round was led by ACME Capital, joining existing investors Andreessen Horowitz, Eclipse Ventures and The House Fund.

Image Credits: Symbio

“Instead of exclusively providing automation solutions, Symbio is also designing the tools that enable the developers and domain experts working in manufacturing to create their own automation solutions and easily adapt them to new tasks,” UC Berkeley professor Anca Dragan said in a statement tied to the news. “To do this, they are building products that leverage AI strengths and human insight in a symbiotic way.”

Founded in 2014, the company employs around 40, mostly engineers, largely based in California. Reynolds explains that the current level of automated manufacturing in automotive is actually far lower than one might expect. “Assembly is less than 5% automated, across the board,” he says. “Even in this core vertical, there’s a ton of headroom and opportunity for growth.”

from Startups – TechCrunch https://ift.tt/3kv1CRr

Comments

Post a Comment