According to a new report from Bloomberg, the launch of the Apple Card is imminent. Customers based in the U.S. should be able to order the new credit card at some point during the first half of August.

Rumor has it that the most recent update of iOS contains everything needed for the Apple Card. The company can flip a server-side switch in order to launch the card.

Bloomberg also reported a few weeks ago that Apple’s retail employees have been able to sign up to the Apple Card and test it before the official release date.

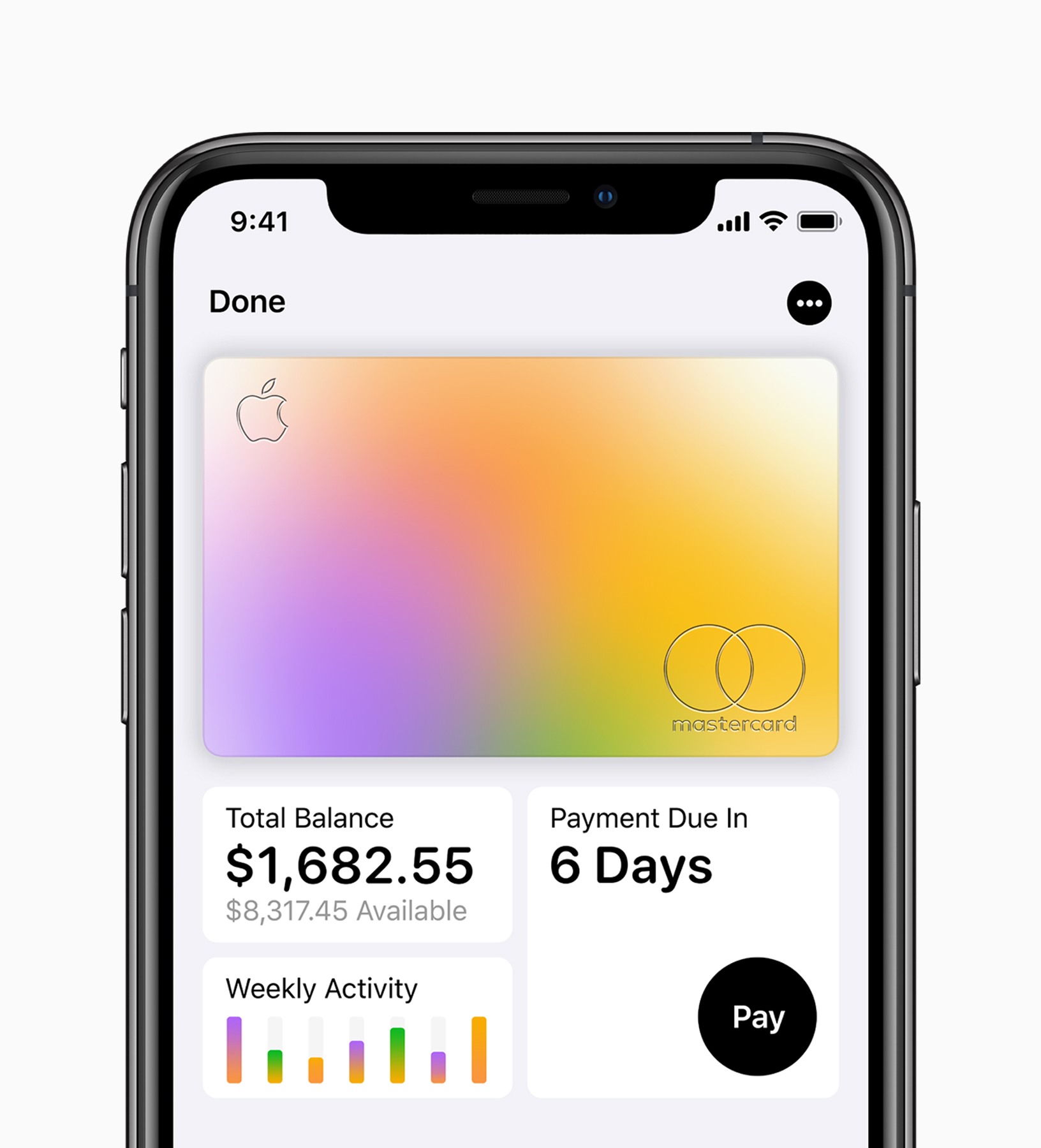

As a reminder, Apple has partnered with Goldman Sachs on a credit card for U.S. customers. Goldman Sachs manages the banking infrastructure while Apple controls the user experience. You’ll be able to sign up directly from the Wallet app on your iPhone. You can then use your Apple Card with Apple Pay, but you also receive a plastic card that works on the Mastercard network.

In addition to a list of your most recent transactions, you can see a breakdown of your purchases by category. There’s no monthly fee and no foreign transaction fee with the Apple Card. And you get 1% back when you pay with your card, 2% if you pay using Apple Pay and 3% if it’s an Apple purchase.

Cash back is credited directly on your Apple Cash card. You can pay for things using this balance through Apple Pay, make a payment on your Apple Card or transfer it to your bank account.

When it comes to security, you won’t find any credit card number on the card. Instead, when you want to pay for something on a website that doesn’t support Apple Pay, you get a virtual card number in the Wallet app.

The Apple Card was originally announced back in March. At the time, the company said that it would be available this summer.

from Apple – TechCrunch https://ift.tt/2LOTEnJ

Comments

Post a Comment