Who doesn’t want a vacation home?

Right. That’s what I thought.

Kocomo is a Mexico City-based startup that wants to help make that dream a reality. And it’s just closed on a $6 million equity and $50 million debt financing to advance on that goal.

The company aims to allow for cross-border co-ownership of luxury vacation properties that goes beyond the historical use of timeshares. Put simply, the founders of Kocomo — who are a mix of Colombian, British, Mexican, American, Panamanian — want to upend conventional vacation home ownership with a marketplace that gives people a way to purchase, own, and sell fractional interests in luxury homes. Or even more simply, Kocomo’s mission is to make the dream of vacation home ownership “an attainable reality for more people around the world.”

Founded this year, it has been operating in stealth mode since May, recently launching a beta version of its website to engage with a “select” group of clients from its waiting list.

“We are focused initially on Americans and Canadians wanting to buy a vacation home in Mexico, the Caribbean and Costa Rica and then eventually we will be doing the same in Europe,” said Martin Schrimpff, co-founder and CEO of Kocomo.

AllVP and Vine Ventures co-led the equity portion of the financing, which included participation from Picus Capital, Fontes – QED, FJ Labs, and Clocktower Technology Ventures and JAWS — the family office of SWG Chairman Barry Sternlicht. Architect Capital provided the debt investment.

Interestingly, the founders of four Latin American unicorns also put money in the equity round, including Mate Pencz and Florian Hagenbuc of Loft, Oskar Hjertonsson of Cornershop, Carlos Garcia of Kavak and Sergio Furio of Creditas.

No doubt the COVID-19 pandemic had many people reassessing their views about life and work.

In Schrimpff’s case, spending more time with friends and family became a top priority and he accelerated his plans to find a vacation home. But he was disappointed as he explored options.

“Buying an entire vacation home that I was only going to use a few weeks a year, and which I’d have to manage myself, seemed wasteful, stressful and outdated,” he said. “Furthermore, it was impossible to find a beautiful house on the beach in Mexico that fell within my budget.”

The experience of renting an Airbnb year after year, with what Schrimpff described as having “inconsistent quality and lack of professional management,” did not make sense to him either.

And so, as he discussed his frustration with his now co-founders, the idea for Kocomo was born.

Image Credits: Left to right: Kocomo co-founders Tom Baldwin, Martin Schrimpff, Graciela Arango (Brian Requarth not pictured) / Kocomo

The startup’s model is similar to that of another early-stage proptech based here in the U.S. called Pacaso.

In Schrimpff’s view the biggest difference between the two models is that Pacaso is focused more on the second home market in places that are one to two hour drive from where the owners are living.

“Kocomo is focused more on the cross-border vacation homes which are more like a two to three hour flight away from where the owners are located,” he said. Also, “the complexities and problems” tackled by Kocomo are larger considering that they involve cross-border transactions, according to Schrimpff.

Another big differentiator from Pacaso is that Kocomo gives owners the option to “rent their weeks,” added Schrimpff.

In the same way that Netjets uses shared ownership to create an opportunity for people to enjoy the benefits of private air travel, Kocomo aims to apply a co-ownership model to vacation homes, he said.

“Our platform enables multiple people to own and enjoy a luxury vacation home and split all the costs amongst them without the fuss and hassle normally involved,” explained CFO and co-founder Tom Baldwin. “We call this the smarter way to own a home abroad. Buying a whole home for just a few weeks a year feels like more hassle than it’s worth while spending money on a rental is a waste and an expense, not an asset.”

Kocomo, said co-founder and CPO Graciela Arango, manages all of the legal and administrative processes that come with home acquisition and ownership. For example, it purchases the home through an LLC, finds and vet qualified co-owners, allocates time equitably among the co-owners and performs all of the services necessary to manage and maintain the home over time. It even deals with managing utilities, landscaping and preventive maintenance.

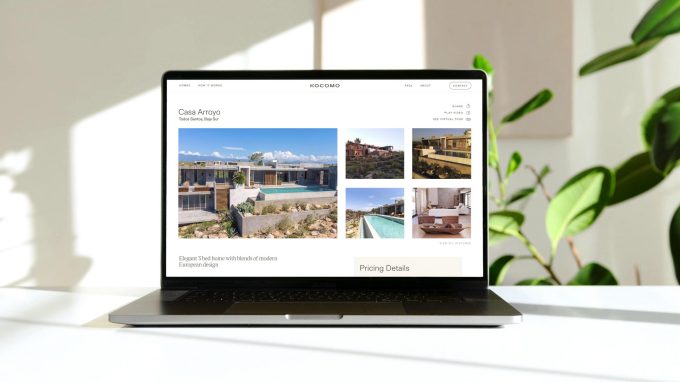

Image credit: Kocomo

The company plans to use its equity capital in part toward increasing the number of its 9-person staff, with a particular focus on sales, marketing, and engineering. It also, naturally, plans to invest in the technology that powers its platform. The debt capital will go towards the acquisition of about 20 luxury vacation properties in “sought after” destinations in Mexico that are close to airports with international flights — such as Los Cabos, Punta Mita and Tulum.

Next, the company plans to expand to other vacation destinations within direct flying distance of the U.S., such as Costa Rica and the Caribbean. Down the line, the company sees “huge potential” in ski locations, Mediterranean beach destinations and cultural centers such as Paris, London, Madrid and Berlin.

Kocomo has also Identified a financial institution partner so that it can provide financing to clients for the purchase of ownership interests in properties on our platform, and is in late-stage discussions to formalize the partnership, according to Baldwin.

“Whereas many startups coming out of stealth mode focus on going from 0 to a high number of sales quickly, our primary focus initially is to go from 0 to 10 Kocomo qualified co-owners,” said Schrimpff. “Even though we are a B2C company, since our ticket size is upwards of $200,000, our sales cycle exhibits a trajectory more akin to that of a B2B startup.”

Interestingly, but not surprisingly, Kocomo is seeing that most of its early interest is coming from people in the tech community. Pacaso, too, saw a similar trend.

“This profile fits our model because they often have flexibility in their calendars, or ability to work remotely, and are open to trying new models, especially if they feel like this is a savvier way to become an owner,” said Schrimpff.

AllVP’s Antonia Rojas said that Kocomo is leveraging technology to deliver “an evolved model of real estate ownership which taps into deep-seated changes in the way consumers organize and prioritize work, family, and free time in a post-COVID world.”

The firm was also impressed by the caliber of the team. Schrimpff founded and later sold PayU, a global payments business now owned and controlled by Naspers. Baldwin is a former Goldman Sachs banker who spent the last 8 years as a venture capital and private equity investor in Mexico and Brazil. Arango graduated from Harvard Business School, and previously worked at IDEO in Silicon Valley. Brian Requarth, co-founder & non-executive chairman, previously founded real estate classifieds company Vivareal.

from Startups – TechCrunch https://ift.tt/3ztwXdN

Comments

Post a Comment