The media licensing business is a massive market, but much of the work involved is still handled manually through emails and spreadsheets. A startup called Flowhaven is working to change that. The company, which has now closed on $16 million in Series A funding, helps brands to manage their licensing partnerships, including the account management aspects, the individual product information, the financial information, and more.

The new round was led by Sapphire Sport, the part of Sapphire Ventures that specializes in sports, media and lifestyle brands. Existing investors Global Founders Capital and Icebreaker.vc also returned, bringing Flowhaven’s total raise to date to $21.5 million.

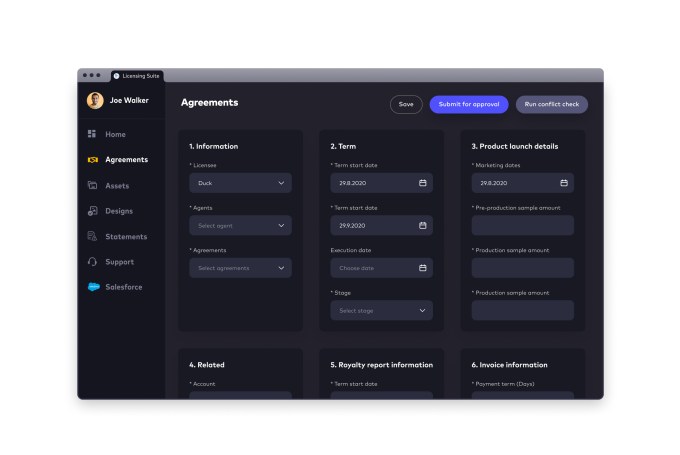

Image Credits: Flowhaven

The idea to modernize the media licensing business comes from a founder who had direct experience in the industry.

Flowhaven CEO Kalle Törmä previously worked on licensing for the Angry Birds mobile game franchise while at Rovio, starting back in 2012. While there, he created the global blueprint for managing the merchandising side of the business, which later expanded to include partnerships for the Angry Birds Star Wars and Angry Birds Transformers games.

“It was evident that the workflows were very broken — from managing the commerce, or the agreements, the product approvals, and financials. The information was very siloed. Also, there were a lot of things that fell through the cracks,” explains Törmä.

In addition, it was time consuming and difficult to pull together data that would allow management to understand how the business was doing.

The challenges Törmä faced at Rovio led him to understand what would be needed to create a solution like Flowhaven — particularly, the difficulty of managing tricky licensing workflows and timetables through manual methods.

He left Rovio in 2016 and founded Flowhaven, where he’s joined by university pal and CCO Timo Olkkola, whose background is in sales.

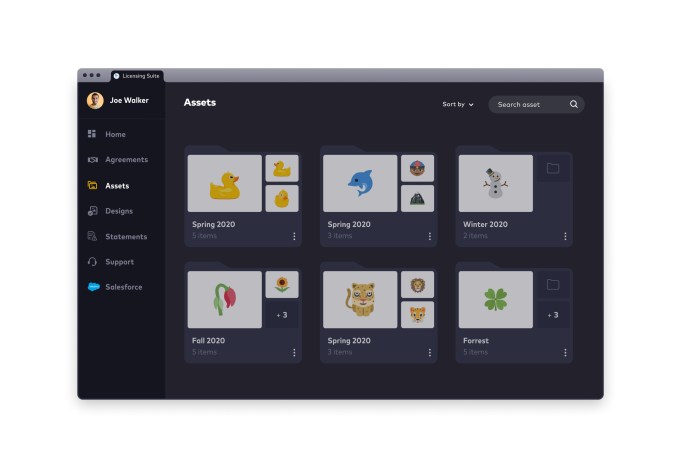

Image Credits: Flowhaven

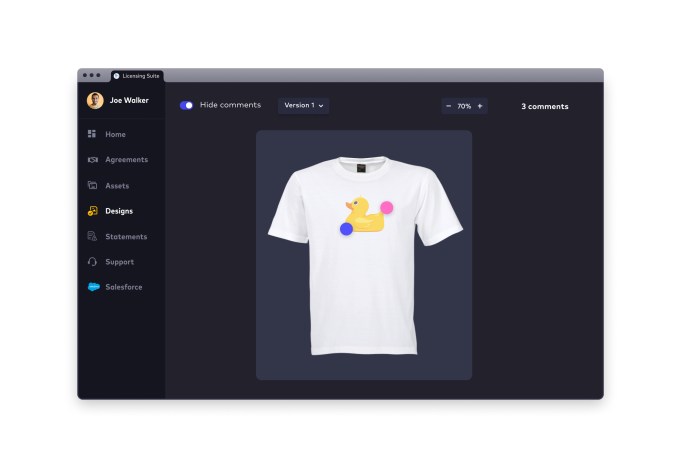

Today, the Flowhaven licensing management platform automates the brand licensing workflow process, including the planning and strategy, account and agreement management, content distribution, design approvals, royalty reporting, and more.

It also helps to keep teams on schedules that can often be tight in the media and entertainment businesses.

“There’s always a timeframe that they follow — whether it’s a film release or game release,” Törmä says. “There are lot of moving pieces in closing all the agreements and then moving the products through the approvals [so when], let’s say, a film comes out, a couple of months prior, the merchandise hits the retail shelves,” he says.

“If you don’t have the products approved and ready, then you didn’t really seize the momentum,” Törmä adds.

Image Credits: Flowhaven

Flowhaven pitches that its software isn’t just saving time, it also saves money. The company estimates that licensing professionals waste 50 hours per month at $70 per hour on work that could be automated. This equals approximately $42,000 per year wasted for a single professional.

As of its new funding, Flowhaven’s software-as-a-service platform has been adopted by close to 100 companies, ranging from smaller business to Fortune 100 companies in markets like media, entertainment, sports, fashion, and by corporate and consumer brands Though some customer names can’t be shared, Flowhaven says it’s working with Nintendo, LAIKA, Games Workshop, Acamar Films, and Crunchyroll.

Its pricing is based on how many users will be on the platform. This doesn’t include those with guest access outside the organization, who are always free of charge.

The company also reports 400% year-over-year growth and says it’s expecting that trend to continue, but declines to share its current revenue figures.

The additional funding will help Flowhaven fuel its growth, expand its product and platform, and aid in hiring, Törmä says. Today, the company’s staff is split between offices in Helsinki, London and L.A. but says it’s seeing the most growth in the latter two.

In terms of the product itself, the plan is to further develop Flowhaven’s analytics and speed up the process of exchanging information between the brand owners and their licensees.

Already in 2021, Flowhaven is growing. It began the year with a team of 30 and is now 43 people. Throughout the year, Törmä says the team will grow to nearly 100.

from Startups – TechCrunch https://ift.tt/3otGCuq

Comments

Post a Comment