$28 million-funded crypto startup Tagomi will be the newest member of the Libra Association that governs the Facebook-backed Libra stablecoin, TechCrunch has learned. A formal announcement of Tagomi joining was slated for Friday or next week.

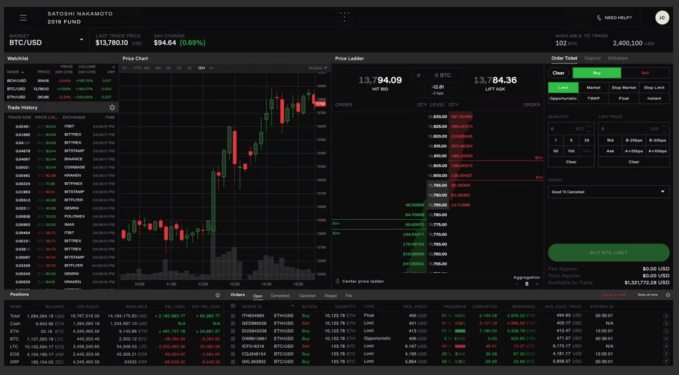

Tagomi offers a platform that helps large traders and funds easily access cryptocurrency markets. The news comes days after Libra added Shopify, a reversal of dwindling membership after major partners like Visa, PayPal, and Stripe dropped out late last year.

We’ve reached out to the Libra Association and have been promised a response by Facebook’s communications team.

Joinin Libra means Tagomi will be expected to contribute at least $10 million towards developing the cryptocurrency, with that investment eligible to reap dividends from interest earned on money kept in the Libra Reserve. Tagomi will also operate a node that validates transactions coming through the Libra blockchain.

Tagomi was founded by Jennifer Campbell, a former investor at Union Square Ventures which is also a Libra Association Member. The company has 25 employees across 5 offices. Tagomi will be the 22nd member of the Libra Association, according to information from the startup’s press representative who was apparently supposed to hold this news until later. “Tagomi is joining the Libra Foundation and Jennifer will be the newest member” they emailed TechCrunch. We’ll update this story following our interview with Campbell tomorrow.

Campbell and Tagomi will offer technical and policy support to Libra in an effort to make the cryptocurrency more safe and compliant with international law. That will be critical for the Libra Association to get the greenlight from regulators for a launch in 2020 like it originally planned. Lawmakers in the US and EU have slammed Libra in hearings and the press over its potential to facilitate money laundering, harm privacy, and destabilize the global financial system.

The full membership of the Libra Association is now:

Current Members:

Facebook’s Calibra, Tagomi, Shopify, PayU, Farfetch, Lyft, Spotify, Uber, Illiad SA, Anchorage, Bison Trails, Coinbase, Xapo, Andreessen Horowitz, Union Square Ventures, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking.

Former Members:

Vodafone, Visa, Mastercard, Stripe, PayPal, Mercado Pago, Bookings Holdings, eBay.

from Startups – TechCrunch https://ift.tt/32tnOSN

Comments

Post a Comment