Indian tech startups have never had it so good.

Local tech startups in the nation raised $14.5 billion in 2019, beating their previous best of $10.5 billion last year, according to research firm Tracxn.

Tech startups in India this year participated in 1,185 financing rounds — 459 of those were Series A or later rounds — from 817 investors.

Early stage startups — those participating in angel or pre-Series A financing round — raised $6.9 billion this year, easily surpassing last year’s $3.3 billion figure, according to a report by venture debt firm InnoVen Capital.

According to InnoVen’s report, early stage startups that have typically struggled to attract investors saw a 22% year-over-year increase in the number of financing deals they took part in this year. Cumulatively, at $2.6 million, their valuation also increased by 15% from last year.

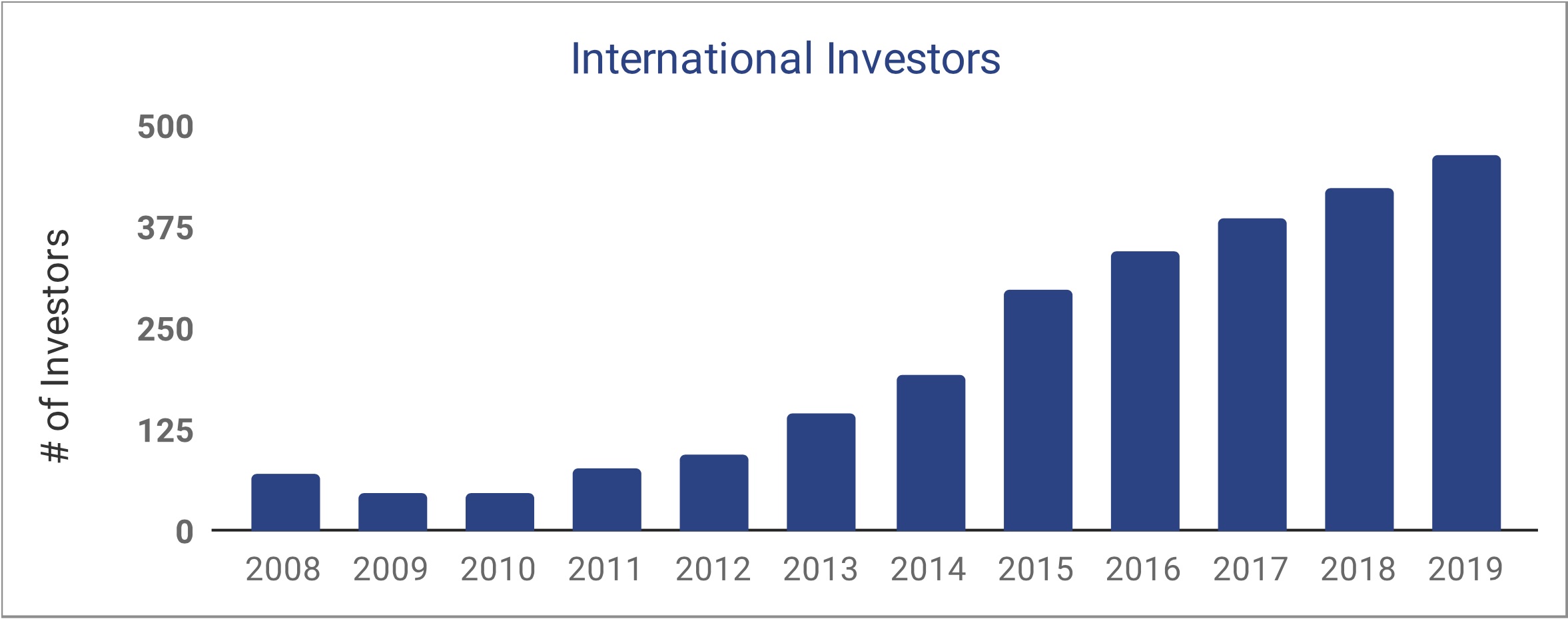

Also in 2019, 128 startups in India got acquired, four got publicly listed, and nine became unicorns. This year, Indian tech startups also attracted a record number of international investors, according to Tracxn.

This year’s fundraise further moves the nation’s burgeoning startup space on a path of steady growth.

Since 2016, when tech startups accumulated just $4.3 billion — down from $7.9 billion the year before — flow of capital has increased significantly in the ecosystem. In 2017, Indian startups raised $10.4 billion, per Tracxn.

“The decade has seen an impressive 25x growth from a tiny $550 million in 2010 to $14.5 billion in 2019 in terms of the total funding raised by the startups,” said Tracxn.

What’s equally promising about Indian startups is the challenges they are beginning to tackle today, said Dev Khare, a partner at VC fund Lightspeed Venture Partners, in a recent interview to TechCrunch.

In 2014 and 2015, startups were largely focused on building e-commerce solutions and replicating ideas that worked in Western markets. But today, they are tackling a wide-range of categories and opportunities and building some solutions that have not been attempted in any other market, he said.

Tracxn’s analysis found that lodging startups raised about $1.7 billion this year — thanks to Oyo alone bagging $1.5 billion, followed by logistics startups such as Elastic Run, Delhivery, and Ecom Express that secured $641 million.

176 horizontal marketplaces, more than 150 education learning apps, over 120 trucking marketplaces, 82 ride-hailing services, 42 insurance platforms, 33 used car listing providers, and 13 startups that are helping businesses and individuals access working capital secured funding this year.

The investors

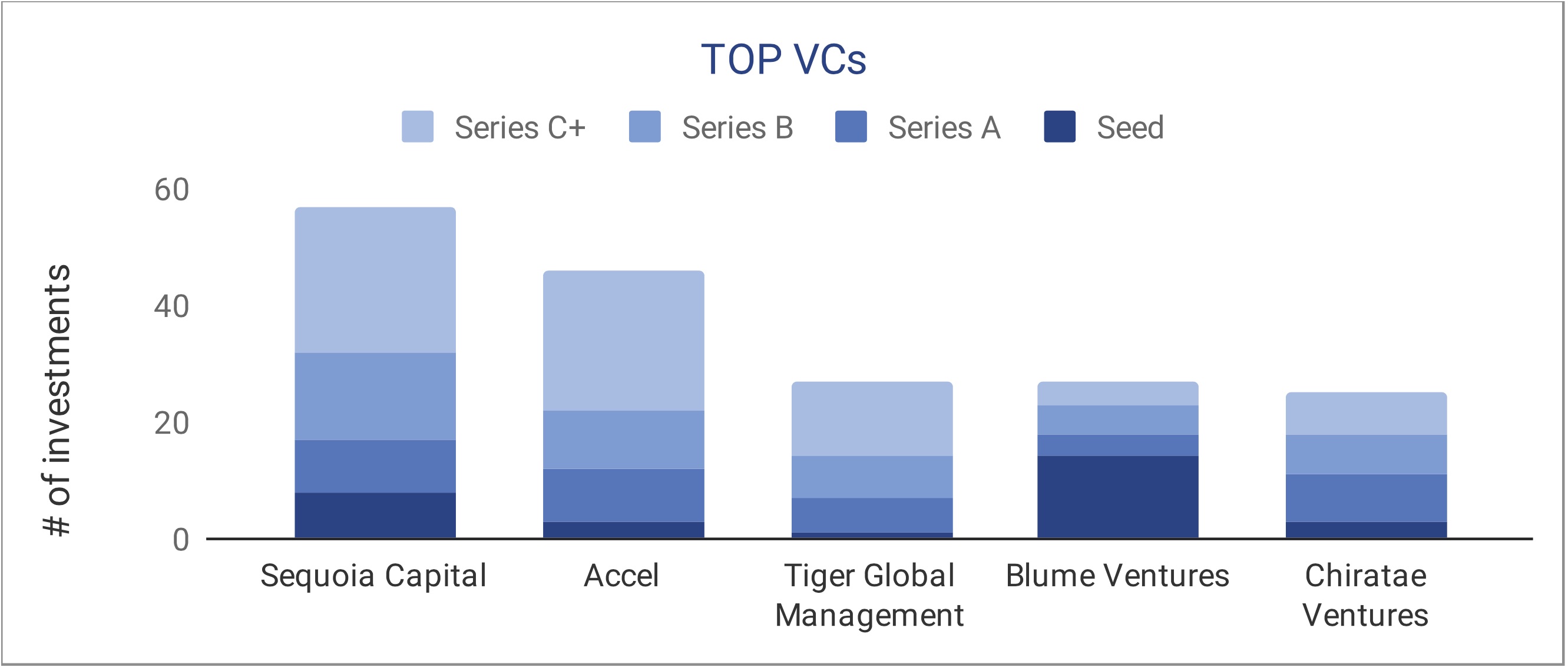

Sequoia Capital, with more than 50 investments — or co-investments — was the most active venture capital fund for Indian tech startups this year. (Rajan Anandan, former executive in charge of Google’s business in India and Southeast Asia, joined Sequoia Capital India as a managing director in April.) Accel, Tiger Global Management, Blume Ventures, and Chiratae Ventures were the other top four VCs.

Steadview Capital, with nine investments in startups including ride-hailing service Ola, education app Unacademy, and fintech startup BharatPe, led the way among private equity funds. General Atlantic, which invested in NoBroker and recently turned profitable edtech startup Byju’s, invested in four startups. FMO, Sabre Partners India, and CDC Group each invested in three startups.

Venture Catalysts, with over 40 investments including in HomeCapital and Blowhorn, was the top accelerator or incubator in India this year. Y Combinator, with over 25 investments, Sequoia Capital’s Surge, Axilor Ventures, and Techstars were also very active this year.

Indian tech startups also attracted a number of direct investments from top corporates and banks this year. Goldman Sachs, which earlier this month invested in fintech startup ZestMoney, overall made eight investments this year. Among others, Facebook made its first investment in an Indian startup — social-commerce firm Meesho and Twitter led a $100 million financing round in local social networking app ShareChat.

from Startups – TechCrunch https://ift.tt/2Q7LyHD

Comments

Post a Comment