Fabric’s new app helps parents with the hard stuff, including wills, life insurance & shared finances

A new app called Fabric aims to make it simpler for parents to plan for their family’s long-term financial well-being. The goal is to offer parents a one-stop-shop that includes the ability to ability for term life insurance from their phone, create a free will in about five minutes, and collaborate with a spouse or partner to organize key financial accounts or other important documents. In addition, parents are able to coordinate with beneficiaries, children’s guardians, attorneys, financial advisors, and others right from the app.

Fabric was originally founded in 2015 by Adam Erlebacher, previously the COO at online bank Simple, and Steven Surgnier, previously the Director of Data at Simple. The company last year raised a $10 million Series A led by Bessemer Venture Partners, after having sold life insurance coverage to thousands of families.

Since launch, Fabric has expanded beyond life insurance to offer other services, like easy will creation and the addition of tools that help families organize their financial and legal information in one place. The idea, the company explained at the time, was to offer today’s busy parents a better alternative to meetings with agents to discuss complicated life insurance products. Instead, the company offers a simple, 10-minute life insurance application and the option to connect with a licensed team if they need additional help, as well as a similarly simplified will creation workflow.

As with the founders’ earlier company, Simple, which offered a better front-end to banking while actual bank accounts were held elsewhere, Fabric’s life insurance policies are issued by “A” rated insurer, Vantis Life, not Fabric itself.

However, until now, Fabric’s suite of services were only available on the web. They’re now offered in an app for added convenience. The app is initially available on iOS with an Android version in the works.

“Money can be especially stressful when you’re trying to build a family and a career,” said Fabric co-founder and CEO Adam Erlebacher. “In one survey by Everyday Health, 52% of respondents said financial issues regularly stress them out, and people between the ages of 38 to 53 were the most stressed out financially. Parents want to have more control over their families’ long-term financial well-being and today’s dusty old products and tools are failing them,” he added.

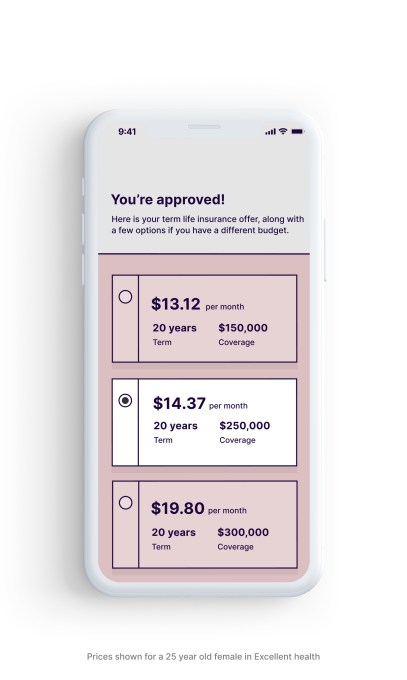

Using the Fabric app, parents can take advantage of any of its offerings, including the option to apply for life insurance from the phone and get immediate approval. The app also makes it possible to share the policy information with beneficiaries, so it doesn’t get lost.

Another feature lets you create your will for free, and share that information with key people as well, including the witnesses you need to coordinate with in order to finalize the will, for example. And a spouse can choose to mirror your will, which speeds up the process of creating a second one with the same set of choices.

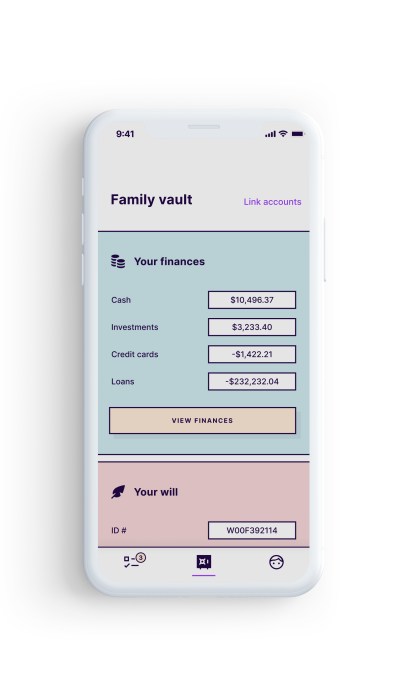

Fabric also helps to address an issue that often only comes up after it’s too late or in other emergency situations — organizing both parents’ finances in a single place. Many working adults today have not just a bank account, but also have investment accounts, 401Ks, IRAs, and credit cards, or a combination of those. But their partner may not know where to find this information or where the accounts are held.

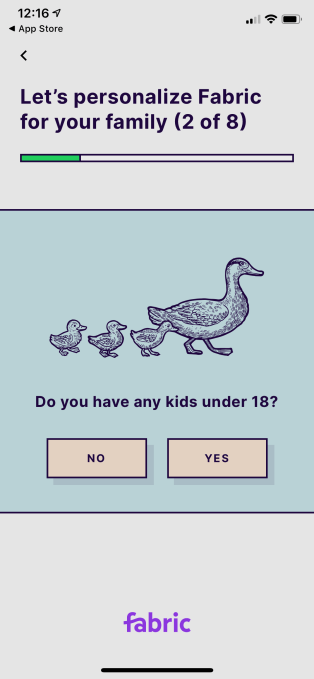

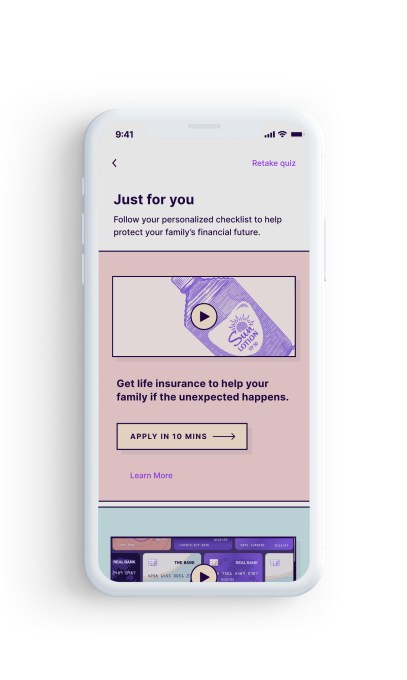

The app, which we put through its paces (but didn’t purchase life insurance through), is very easy to use. It starts off with a short quiz to get a handle on your financial picture. It then delivers you to a personalized homescreen with a checklist of suggestions of what to do next. Naturally, this includes the life insurance application, as this is where Fabric’s revenue lies. And if you’re lacking a will and have other fiances to organize, these are featured, too.

The online forms are easy to fill out, despite the smartphone’s reduced screen space compared with a web browser, and Fabric has taken the time to get the small touches right — like when you enter a phone number, the numeric keypad appears, for example, or the integration of address lookup so you can just tap on the match and have the rest autofill. It also saves your work in progress, so you can finish later in case you get interrupted — as parents often do. And it explains terms, like “executor,” so you know what sort of rights you’re assigning.

Given its focus, Fabric protects user information with bank-grade security, including 256-bit encryption, two-factor authentication, automatic lockouts, biometrics, and other adaptive security features.

Fabric isn’t alone in helping parents and others financially plan wills and more from their iPhone. Other apps exist in this space, including will planning apps from Tomorrow, LegalZoom, Qwill, and others. Plus many insurers offer a mobile experience. Fabric is unique because it puts wills, insurance, and other tools into a single destination, without complicating the user interface.

Fabric’s app is a free download on the App Store.

from Startups – TechCrunch https://ift.tt/33qE5XF

Comments

Post a Comment