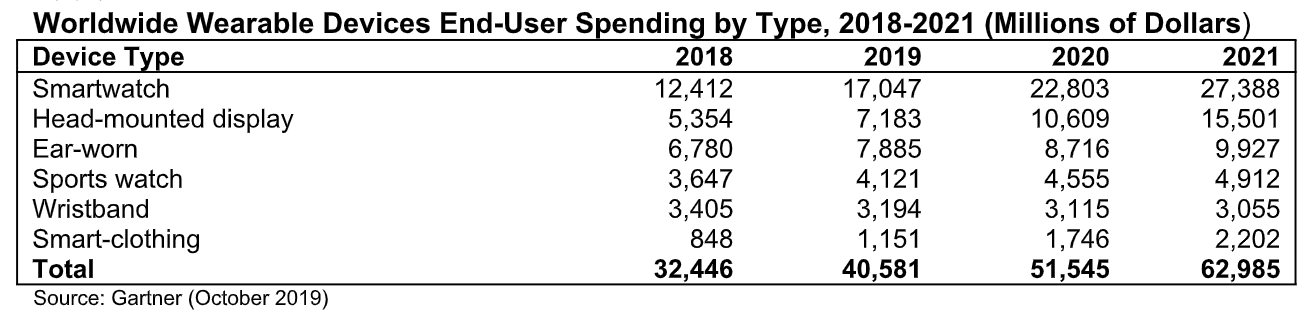

New numbers from Gartner mark another major increase for global wearable spending in 2020. The analyst firm forecasts a 27% jump in end-user spending over this year, from $40.5 billion to $51.5 billion. Once again, the pack is lead by smartwatches, which continue to burn the hottest among in the space.

Interestingly, the increase on smartwatch spending from $17 billion to $22.8 billion will be lead by decreasing prices (a 4.5% decrease in average selling prices in 2021). Those are, in turn, the result of a combination of increased competition from Samsung and some external pressure from Fitbit, which has found a sweet spot at around $200 a unit. Chinese manufacturers like Xiaomi have also gone a ways toward decreasing the price on the low end of the market.

Apple, in turn, has responded by keeping the two-year-old Series 3 on the market at the $200 price point. It’s a sign of a maturing category that no longer commands as much of a premium pricing in past generations. Google, meanwhile, recently bought a fair chunk of IP from Fossil and has reportedly been eyeing a Fitbit acquisition after years of struggling to crack the category.

Headphones have continued steady growth, as well, thanks to an explosion in fully wireless earbuds, lead by Apple and Samsung, with the recent lower cost addition of Amazon. Google, too, has been eying a reentry into the category next year with the return of its much panned Pixel Buds. Even Microsoft plans to enter the category with its unique Surface Buds.

Gartner predicts continued spending growth in wearables for 2021, with spending hitting $62.9 billion.

from Apple – TechCrunch https://ift.tt/34iF64T

Comments

Post a Comment