Captiv8, a company offering tools for brands to manage influencer marketing campaigns, has released its 2018 Fraud Influencer Marketing Benchmark Report. The goal is to give marketers the data they need to spot fake followers — and thus, to separate the influencers with a real following from those who only offer the illusion of engagement.

The report argues that that this a problem with a real financial impact (it’s something that Instagram is working to crack down on), with $2.1 billion spent on influencer marketing on Instagram in 2017 and 11 percent of the engagement coming from fraudulent accounts.

“For influencer marketing to truly deliver on its transformative potential, marketers need a more concrete and reliable way to identify fake followers and engagement, compare their performance to industry benchmarks, and determine the real reach and impact of social media spend,” Captiv8 says.

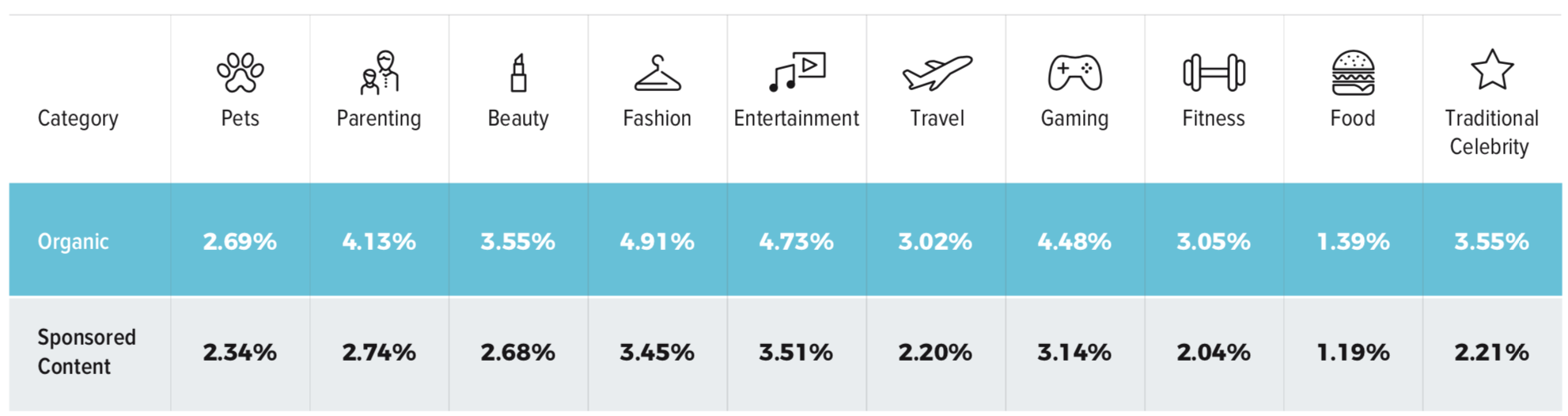

So the company looked at a range of marketing categories (pets, parenting, beauty, fashion, entertainment, travel, gaming, fitness, food and traditional celebrity) and randomly selected 5,000 Instagram influencer accounts in each one, pulling engagement from August to November of this year.

The idea is to establish a baseline for standard activity, so that marketers can spot potential red flags. Of course, everyone with a significant social media audience is going to have some fake followers, but Captiv8 suggests that some categories have a higher rate of fraud than others — fashion was the worst, with an average of 14 percent of fake activity per account, to compared to traditional celebrity, where the average was just 4 percent.

So what should you look out for? For starters, the report says that the average daily change in follower counts for an influencer is 1.2 percent, so be on the look out for shifts that are significantly larger.

The report also breaks down the average engagement rate for organic and sponsored content by category (ranging from 1.19 percent for sponsored content in food to 3.51 percent in entertainment), and suggests that a lower engagement rate “shows a high probability that their follower count is inflated through bots or fake followers.”

Conversely, it says it could also be a warning sign if a creator’s audience reach or impressions per user is higher than the industry benchmarks (for example, image posts in fashion have an average audience reach of 23.69 percent, with 1.32 impressions per unique user).

You can download the full report on the Captiv8 website.

from Startups – TechCrunch https://tcrn.ch/2LwijtY

Comments

Post a Comment